A high-quality ERP system for modern businesses is not a luxury — it’s a necessity. It enables end-to-end data integration, automates key processes, and allows companies to operate more efficiently amid rapid digital transformation.

According to research by Forrester, companies that implemented Microsoft Dynamics 365 saved between 7 and 15 work hours per week for specialists in finance, accounting, logistics, and supply chain teams. This led to an increase in productivity of nearly 78% for finance and accounting professionals, and 65% for logistics and supply chain teams. As a result — an overall increase in business profitability by 6–29%.

However, even though the cost of such an ERP system, according to the same study, pays off fully within three years (ROI = 106%), this investment remains a significant financial challenge for many companies.

The good news for Polish businesses is that investing in an ERP system doesn’t have to rely solely on their own funds. In Poland, there are several effective co-financing tools — both national and European — that can significantly ease the burden on a company’s budget.

In this article, we’ll explore:

- What digitalization support programs are already available to Polish businesses

- What requirements applicants must meet

- What expenses are covered

- How to prepare for the application process

Available ERP Funding Sources: European Programs

Programs at this level are aimed at supporting Poland’s innovation policy through financing provided by European Union institutions.

Currently, most European support fund budgets are allocated for the 2021–2027 period and are distributed through nationwide (country-level) programs that support the digitalization of specific industries across the country, as well as regional programs focused on regional development.

The full list is available on the European Funds Portal (Portal Funduszy Europejskich) website.

These programs are intended for both large companies and MSMEs — micro, small, and medium-sized enterprises.

Large enterprises can receive grants primarily for projects related to research and development of new products and/or innovative technologies. According to data from the National Center for Research and Development of Poland (NCBR), 73 such calls were announced in 2020, with a total budget of PLN 6.9 billion. Based on the signed agreements, project implementers received funding totaling PLN 5 billion.

An example of a nationwide project supporting MSMEs is “Dig.IT. Transformacja cyfrowa”, which enables digital transformation with financial support from the European Union under the European Funds for a Modern Economy (FENG).

The project is designed to support MSMEs in the manufacturing and industrial services sectors, as well as their employees, to accelerate digital transformation in the industry. Importantly, for such smaller enterprises, EU funds can be used to finance, among other things, the purchase and implementation of ERP software — often including necessary IT equipment, implementation services, and training.

Another promising program that supports the digital transformation of small businesses is the “Cyfrowa Europa” (DIGITAL) program.

Startups can also look for funding opportunities for their innovative ideas through programs like the EIT Regional Innovation Booster (EIT RIB) — an initiative of the European Institute of Innovation and Technology (EIT). This program is focused on supporting startups and scale-ups in countries with moderate and medium levels of innovation activity. It provides targeted support to help them grow, enter international markets, and attract additional investment. The program is set to run through 2028.

What Requirements Must Businesses Meet to Qualify for EU Co-Funding of Their ERP Implementation Projects

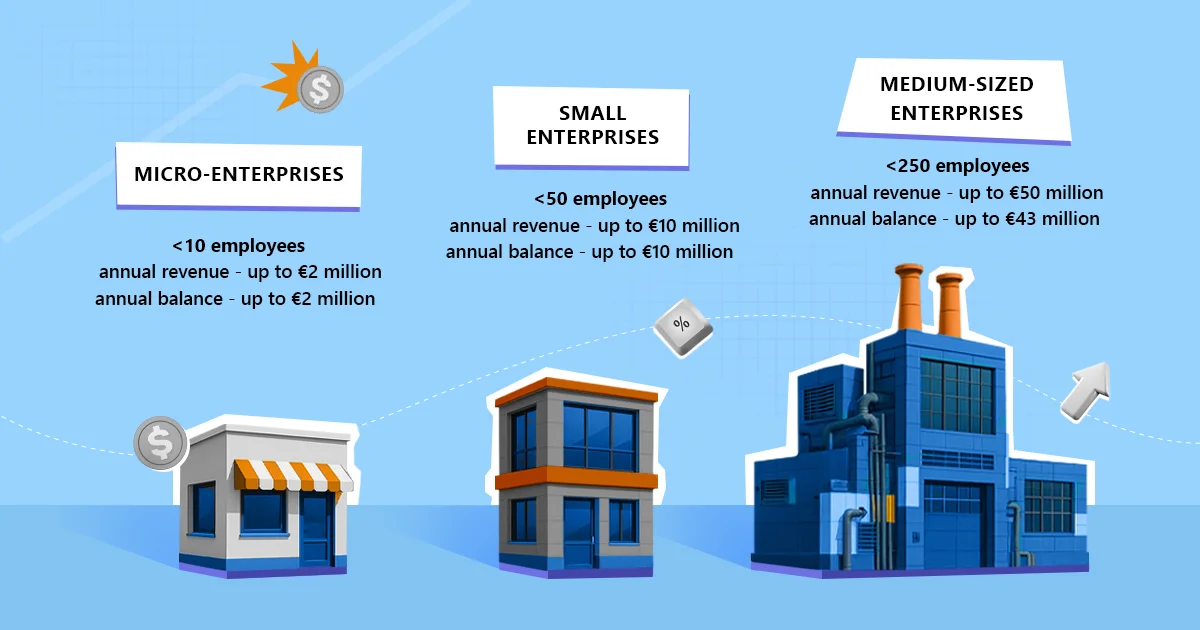

Micro, small, and medium-sized enterprises (MSMEs) have the most straightforward path to accessing such co-funding programs. The classification, according to EU criteria, is as follows:

- Micro-enterprises — fewer than 10 employees, with annual revenue up to EUR 2 million and an annual balance sheet total up to EUR 2 million.

- Small enterprises — fewer than 50 employees, with annual revenue up to EUR 10 million and an annual balance sheet total up to EUR 10 million.

- Medium-sized enterprises — fewer than 250 employees, with annual revenue up to EUR 50 million and an annual balance sheet total up to EUR 43 million.

Where to Start

First, it’s important to focus on identifying programs that are currently available. To do this, start by selecting the geographical scope of your operations (nationwide or specific regions) and the industry in which your business operates. After that — follow the link to view the list of active programs.

What Amount of EU Co-Funding Can a Small Business Expect — and What Can the Funds Be Used For

The amount and terms of co-funding depend on the specific program selected. European programs prioritize projects related to the digital transformation of businesses, automation and robotization of processes, and the implementation of innovative products or technologies — including those based on artificial intelligence.

EU funds can be used to finance, among other things, the purchase of ERP software and expenses related to its implementation (often along with the necessary IT equipment, implementation services, and staff training).

EU funding is typically provided in the form of partial cost reimbursement or advance payments for a portion of the expenses. In most cases, companies are required to finance the initial stages of the ERP implementation project with their own resources.

The level of ERP funding depends on the selected program, the size of the company, and the location of the investment. It can range from several to even dozens of percent of the total investment amount (in some cases – up to 70% of the project cost).

For example, the previously mentioned “Dig.IT. Digital Transformation of Polish SMEs” program offers grants ranging from PLN 150,000 to PLN 850,000, covering up to 50% of digitalization costs.

It is also worth noting that Bank Gospodarstwa Krajowego (BGK), through funds from the FENG program (European Funds for a New Generation), offers entrepreneurs attractive support tools. Although the word “loan” appears in their names, in practice, they function as forms of grants. This applies, in particular, to the Technology and Ecological Loans included in this program list.

What to Pay Attention to When Applying for ERP Co-Funding

Project Innovation

Most grant programs prioritize projects that demonstrate innovation in products, processes, or technologies. For example, this could include implementing an ERP system with artificial intelligence elements, integrating IoT or Big Data into production processes, or automating operations.

It is often also a mandatory requirement that the implemented innovation can be further used to create a new product or provide a new service.

On the other hand, a project that involves deploying standard off-the-shelf solutions (such as a basic financial/accounting system) may not be selected for a grant unless it is part of a broader innovative project or is being implemented by a newly established company.

The key is aligning the project with the objectives of the specific program. Therefore, before applying, it is essential to ensure that the planned expenses fall within the list of eligible costs under the selected call.

For instance, most programs cover costs related to the purchase of ERP system licenses, IT equipment, implementation services, and staff training — and often also consulting services related to project preparation.

Own Contribution and Proof of the Company’s Solvency

Applicants almost always have a better chance of receiving a grant if they can demonstrate the ability to co-finance the ERP implementation project — usually from a few to several dozen percent of the total investment — using their own funds or a loan.

Since reimbursement is provided after completing the agreed part of the project or in the form of an advance for a portion of the expenses, the company must have a sufficient level of liquidity. To confirm this, financial institutions typically require the following:

- a business plan and financial projections

- proof of funding sources (own contribution or loan commitments)

- justification of the expected economic impact of the investment.

The company must also demonstrate that implementing the project is organizationally and financially feasible. In addition, in most cases, it should be prepared for the fact that payments are made only after the project is completed, according to the approved schedule and budget for each project stage.

Location and Business Profile

Each program has its own objective and targets a specific group. Therefore, before applying, it is important to confirm that your company falls within this target group. The criteria may include:

- company size,

- industry (especially relevant for programs focused on sectoral development),

- region of operation (regional calls for proposals require the project to be implemented in a specific voivodeship, or in some cases, a designated subregion),

- market presence: for example, some programs provide support only to companies that have been operating for at least two years, or conversely – to those less than one year old.

Lack of Formal Barriers to Receiving ERP Funding

Before starting work on the project, it is crucial to ensure that your company is not subject to formal exclusion criteria that would disqualify it from receiving support. Specifically:

- the business is not undergoing bankruptcy or liquidation,

- the company does not have a negative track record related to misuse of EU funds in the past,

- the company’s activities do not fall within sectors that the EU excludes from support for regulatory or other reasons (e.g., the company is not subject to sanctions).

Application Accuracy and Alignment with Program Objectives

A properly prepared ERP co-funding application, complete with all required attachments, is a key condition for a company to be selected as a grant recipient.

Special attention should be paid to ensuring the ERP implementation project aligns with the objectives of the program: its implementation must contribute to achieving the outcomes set by the funding institution.

Regardless of the program, the application must include a detailed description of:

- planned expenses,

- the phased implementation timeline,

- expected outcomes and success indicators.

Experts also assess the project’s impact on the company’s competitiveness. Quantifiable indicators of positive impact typically include:

- revenue growth,

- increased number of employees,

- improved productivity of specific departments or businesses as a whole,

- enhanced innovation levels,

- sustainability of results,

- cost-effectiveness (cost-benefit ratio).

It’s important that the application reflects the realities of the business. Avoid submitting a project designed only to fit the call for proposals if it doesn’t align with the company’s actual needs.

Thoroughly addressing all the above aspects contributes to achieving a high score during both the formal and substantive evaluations of the project.

Thus, the key qualification criteria are:

- holding a legal status that allows participation in support programs,

- developing an innovative project that aligns with program objectives,

- maintaining stable financial condition and ability to partially co-finance the project,

- having no grounds for exclusion and meeting all formal requirements of the call.

Meeting all these criteria does not guarantee grant approval — competition is high — but it is a necessary condition for being considered.

The selection of grant recipients is conducted transparently, based on a points system according to defined criteria.

Therefore, companies that carefully design and prepare their ERP implementation project in line with the fund’s requirements stand a real chance of securing financing, which can amount to 15–50% of the total investment.

Successful Cases of Companies That Used Grants to Implement ERP Systems

The experience of local companies that have carried out high-value projects to modernize their IT ecosystems is a powerful motivation to pursue this substantial financial support.

For example, the well-known Polish door manufacturer RADEX Poland, with support from the “Eastern Poland” program (Program Operacyjny Polska Wschodnia 2014–2020), implemented an IT infrastructure modernization project with a total value of PLN 6.15 million, nearly half of which — PLN 2.9 million — was funded through an EU grant.

This project aimed to enhance the company’s competitiveness by optimizing internal processes. It involved the implementation of an ERP system with a WMS module, enabling more efficient management of manufacturing and logistics operations, ultimately reducing costs and increasing productivity.

Another Polish company, pasta producer Goliard Sp. z o.o., also took advantage of EU co-financing to upgrade its IT ecosystem. As part of this project, the company automated production processes, inventory control, and logistics.

In addition to these examples, grants for ERP system implementation have also been awarded to companies in the machinery, furniture, and chemical industries, as well as to medical institutions aiming to optimize their management systems.

For instance, Energoserwis S.A. completed a project in 2022 under the previously mentioned “Eastern Poland” program, which included the implementation of expert recommendations for the company’s development strategy. The project was funded by the EU for more than PLN 2.9 million. As part of this initiative, the company introduced a new ERP system to optimize boiler production management.

Want to learn how an ERP system can help your company reach a new level of efficiency?

Register for a free consultation here.