Every organization is interested in optimizing its financial processes. At the same time, accountants often spend a lot of time for calculation of witholding tax (WHT) and preparing witholding Tax declarations. SMART WHT can put an end to this routine. This effective solution allows organizations quickly, flexibly, and accurately calculate WHT in accordance with the local tax code of a particular country, and easily create appropriate Tax declarations directly from Business Central.

SMART WHT is a universal solution that is ready for use in any country. The only difference is that its localized versions have declarations that are customized to local requirements and comply with the regulatory form of a given country. For example, we have implemented localizations for Georgia and Azerbaijan and are already preparing a customized solution for Poland. We are also planning to develop country-specific connectors that will simply connect to the basic functionality and generate reports that comply with the regulations of a particular country.

How does it work?

SMART WHT allows you to customize WHT depending on different tax rates for different services and suppliers. Moreover, the tax can be calculated using both accrual and cash methods. WHT calculation is done automaticaly during posting of purchase documents and payments to suppliers. The solution also greatly simplifies the process of creating a tax declaration, as it is also automated: in the finished document, all the necessary fields will already be filled in by the system.

The solution gives the possibility of taking into consideration all possible cases that are required according to Georgian Tax Legislation regarding WHT. For example, double taxation agreements, gift taxation, etc.

SMART WHT provides the following benefits:

- Flexible setup of different WHT rates to different services and suppliers

- Save time by automatic calculation of WHT during posting of operations

- Save time by automatic preparation of Tax declaration

- Eliminate risk of Errors

- A comprehensive overview of WHT Entires (base amount, the calculated WHT amount, tax declaration line code etc.)

Features:

- Calculation of WHT for local and foreign suppliers

- Setup of different WHT rates for different services

- Calculate WHT when posting appropriate operations

- Accrual and cash-based calculation of WHT

- WHT declaration formation

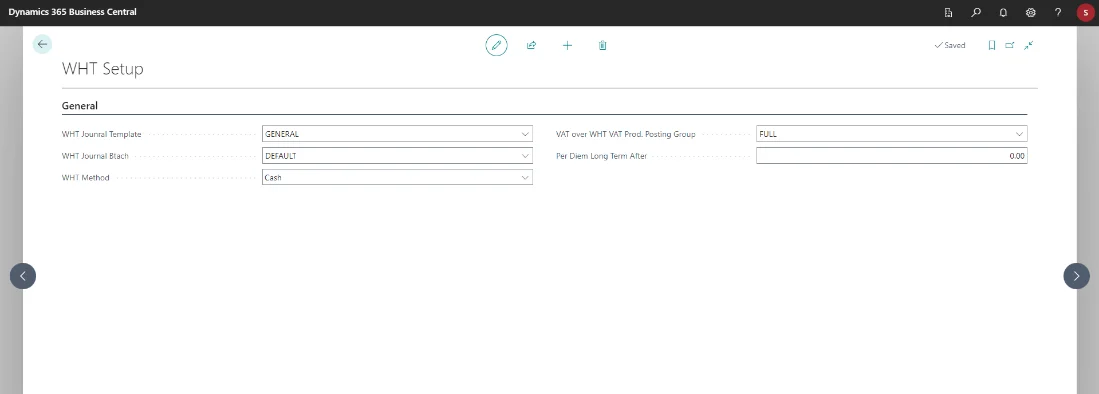

WHT Setup

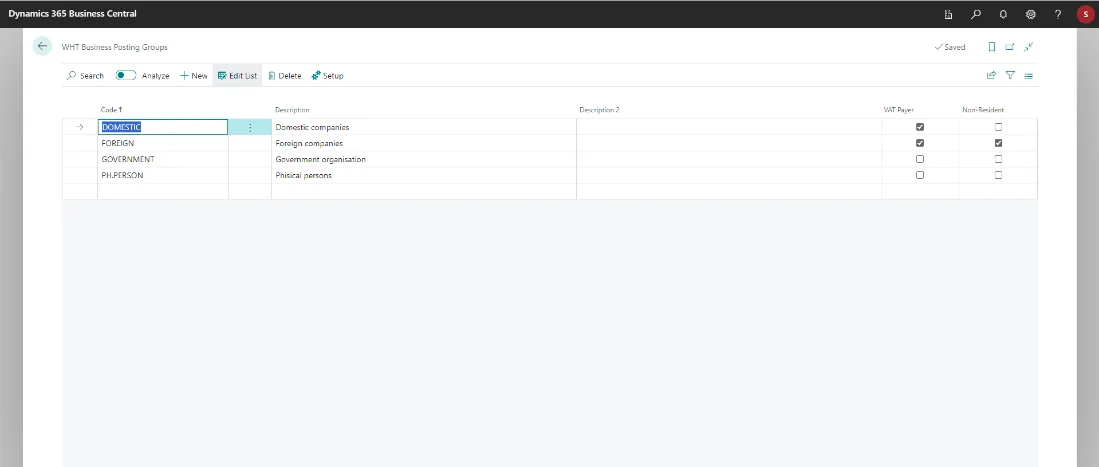

WHT Business Posting Groups

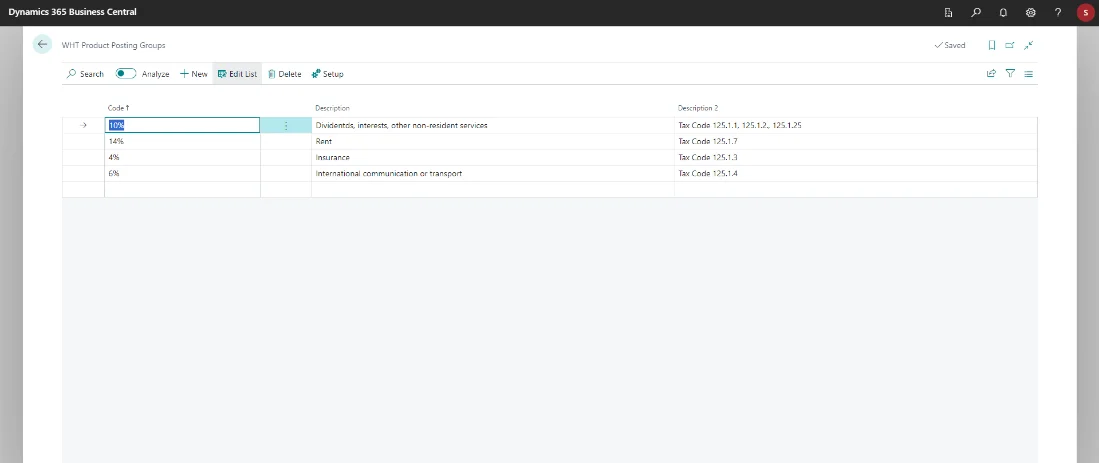

WHT Product Posting Groups

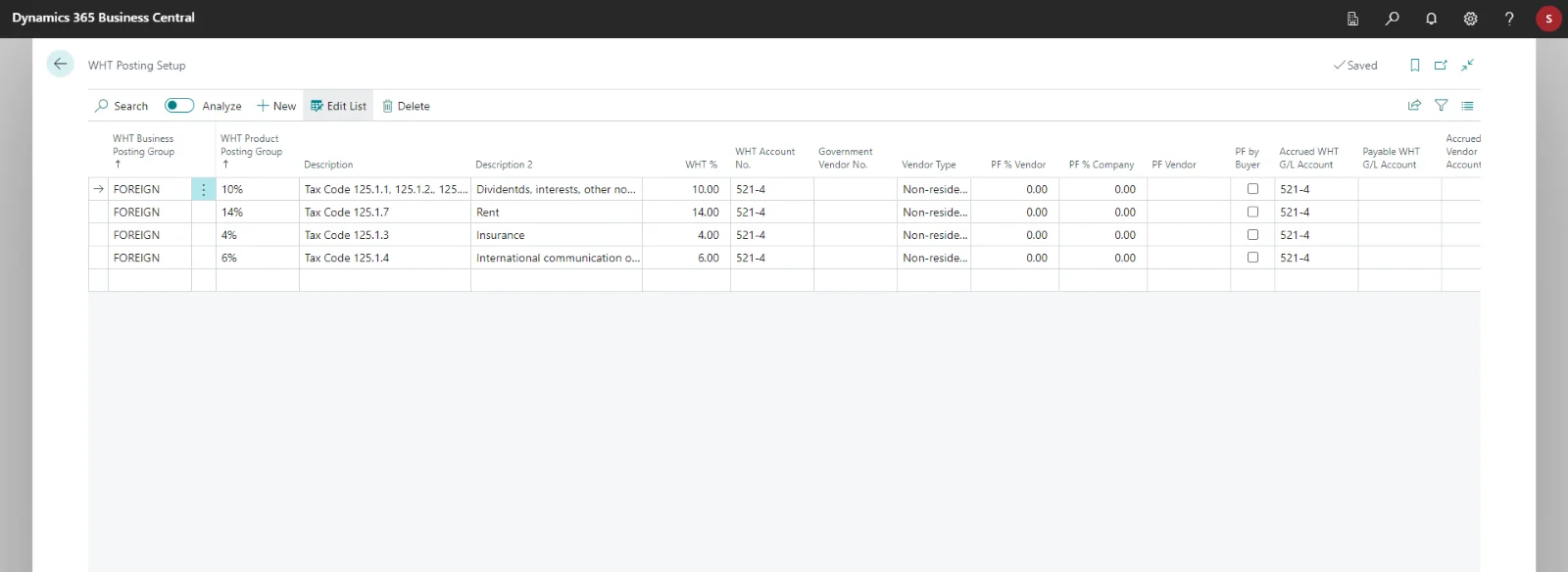

WHT Posting Setup

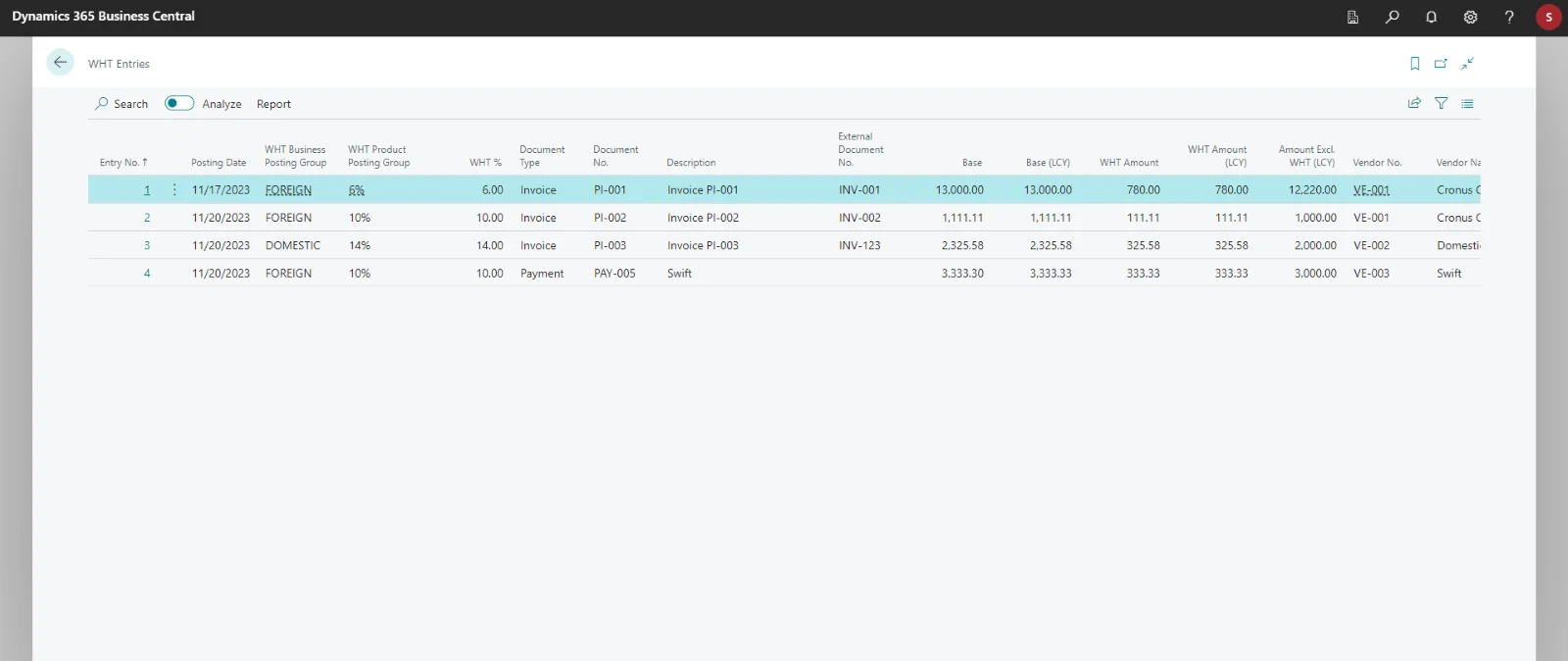

WHT Entries

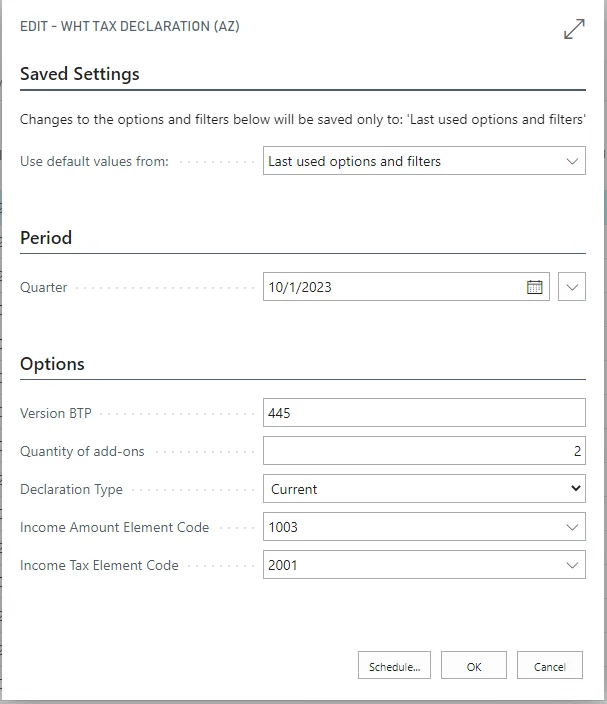

WHT Tax Declaration

As we have already said, SMART WHT is a unified solution. Only declarations that meet the requirements of local laws differ when used in different countries. We have already implemented declarations for Georgia and Azerbaijan, and are preparing a version for Poland.

This is what the declaration for Azerbaijan looks like:

And this is what the declaration for Georgia looks like:

The SMART WHT solution allows for flexible and quick calculation of different tax rates, and can significantly save accountants’ time and effort while avoiding human error.

The product is already available on AppSource: appsource.microsoft.com

Localization for Georgia is available here: appsource.microsoft.com

Do you have more questions? Order a consultation with our experts.