SMART Customs Declaration for Georgia is a solution that allows Georgian companies to conveniently and efficiently manage the import and export of goods directly from Microsoft Dynamics 365 Business Central. With this extension, managers can easily assign numbers to customs documents and track the procurement process. This solution works with SMART Localization, which features rich functionality, takes into account local business requirements, offers flexible operational reporting, out-of-box customization, and continuous enhancements.

How does it work?

SMART Customs Declaration for Georgia simplifies and automates control of customs processes in the system. The solution allows you to assign preferential certificates and additional parameters to items, as well as customs declaration numbers that can be tracked.

Benefits:

- Automates the calculation of customs payments and duties

- Provides information about the current customs declaration

- Provides flexibility to customize changes

- Reduces time spent tracking imported and exported items

- Simplifies the collection of information about customs processes

- Easily adapts to specific business needs

- Complies with the requirements of Georgian legislation

Functionality:

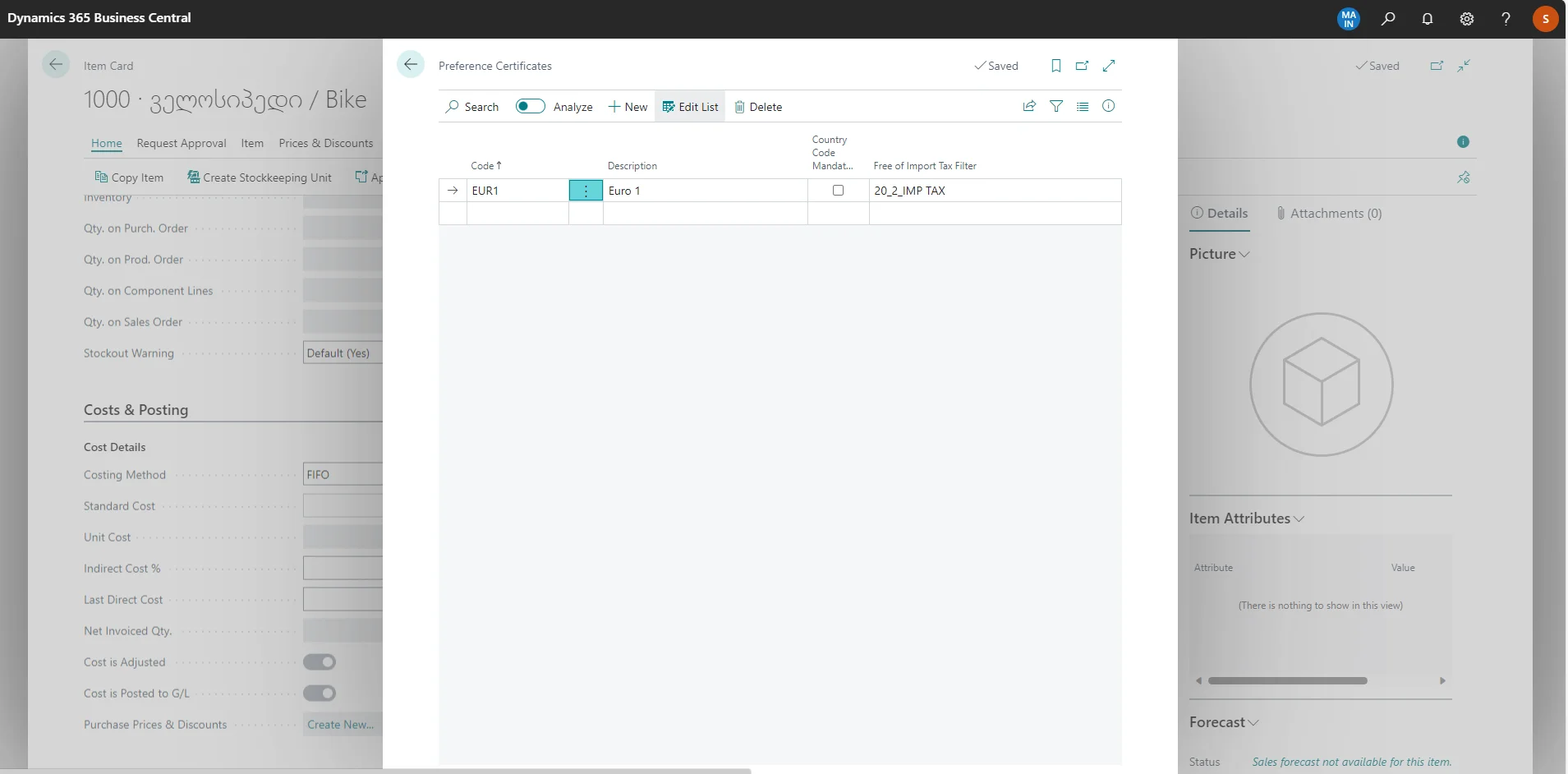

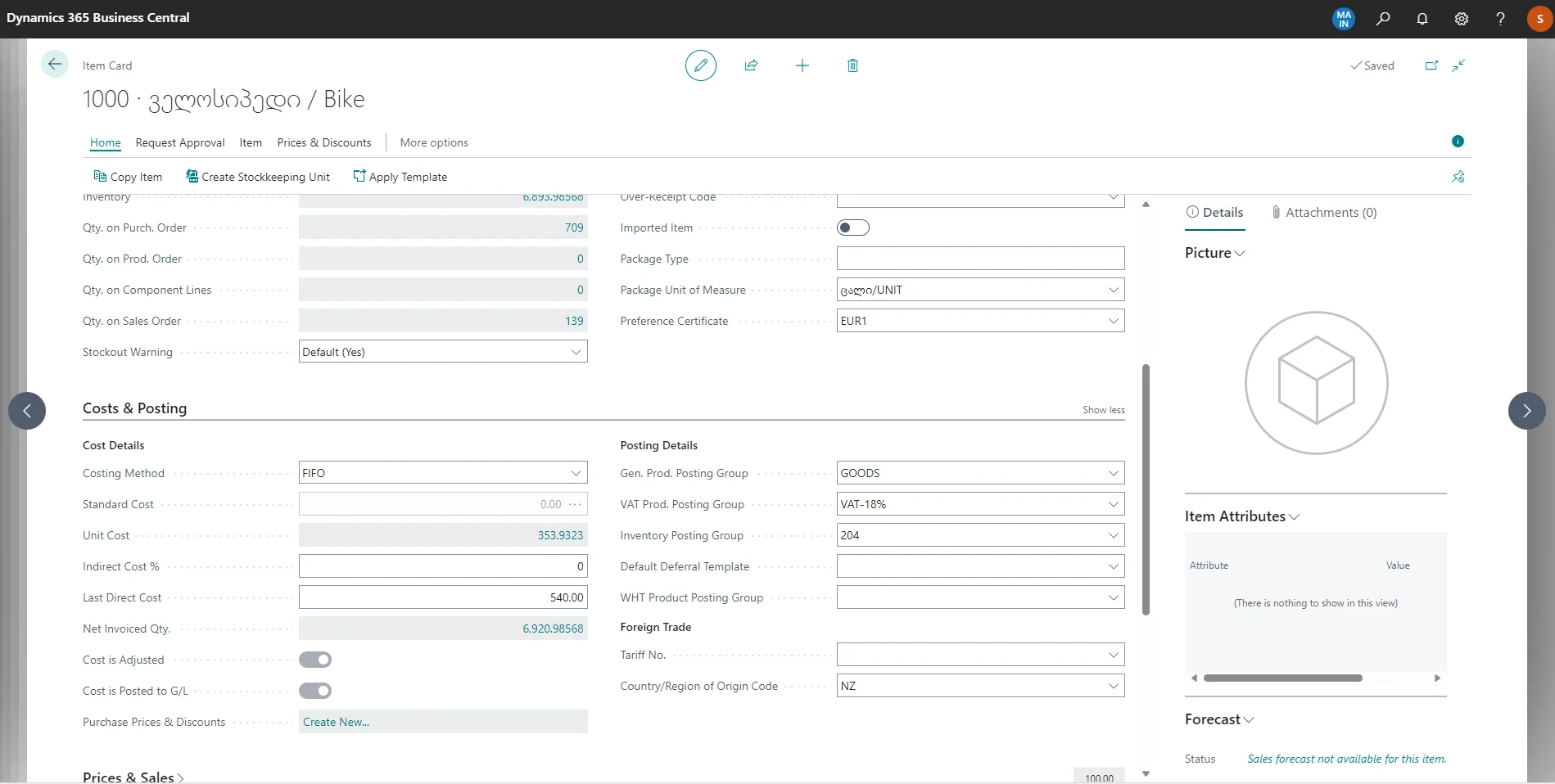

- Assignment of a preferential certificate to an item

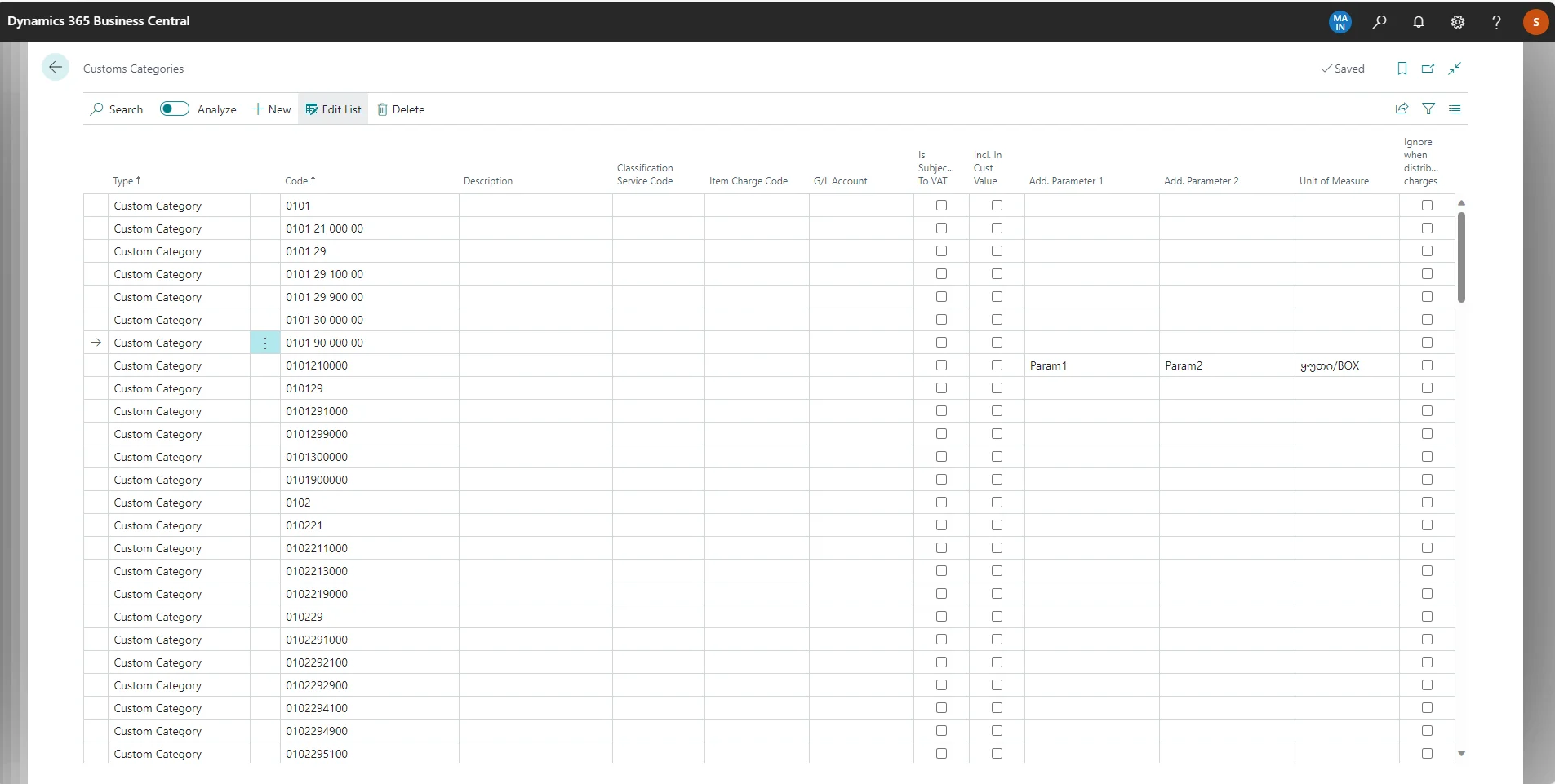

- Additional attribute parameter to customs category codes used in customs reporting

- Control of the accrual of import taxes in the customs declaration in accordance with the presence of a preferential certificate

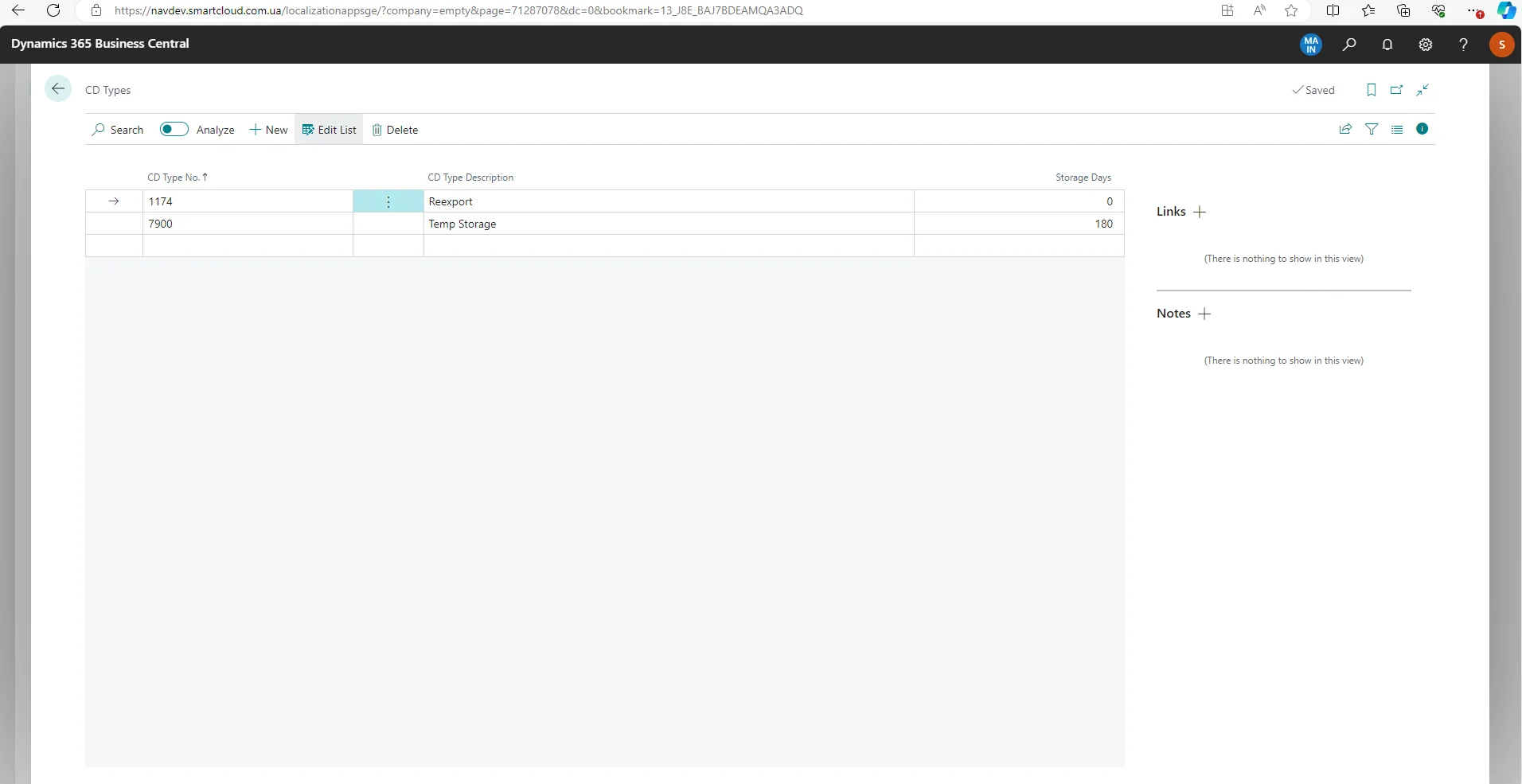

- Control of re-exported items

- Viewing the availability of item transfers in the customs declaration

- Determination of types and numbers of customs declarations

- Calculation of taxes depending on the country of origin of the items

- Assigning serial numbers

Easy import and export management

SMART Customs Declaration for Georgia helps companies importing and exporting goods and dealing with customs documents to easily manage, control and track purchased goods in the system.

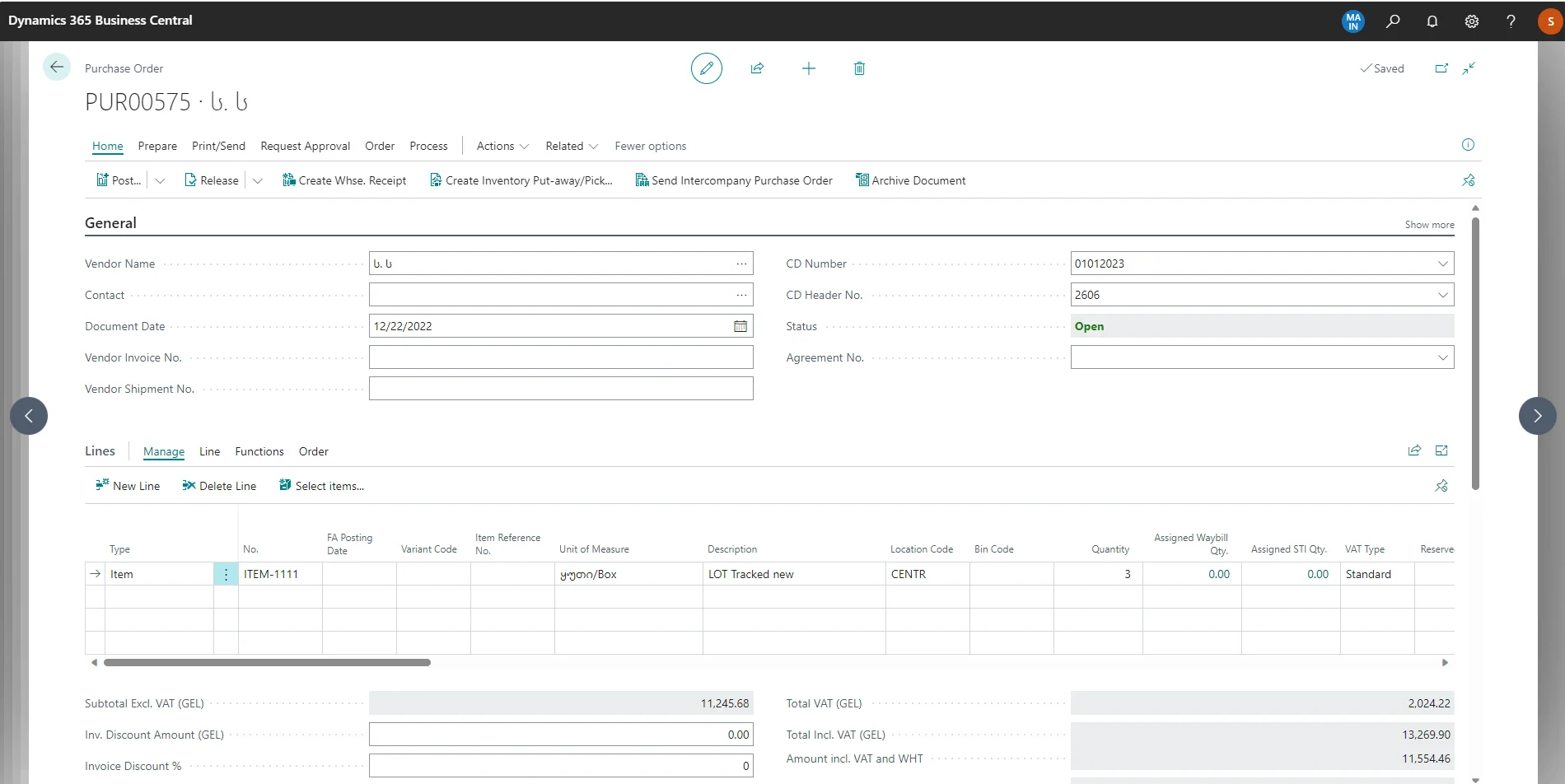

Product items can be assigned customs declaration numbers, which can be flexibly edited at any time throughout the purchasing process. Allows you to simplify and automate the calculation of customs duties and taxes.

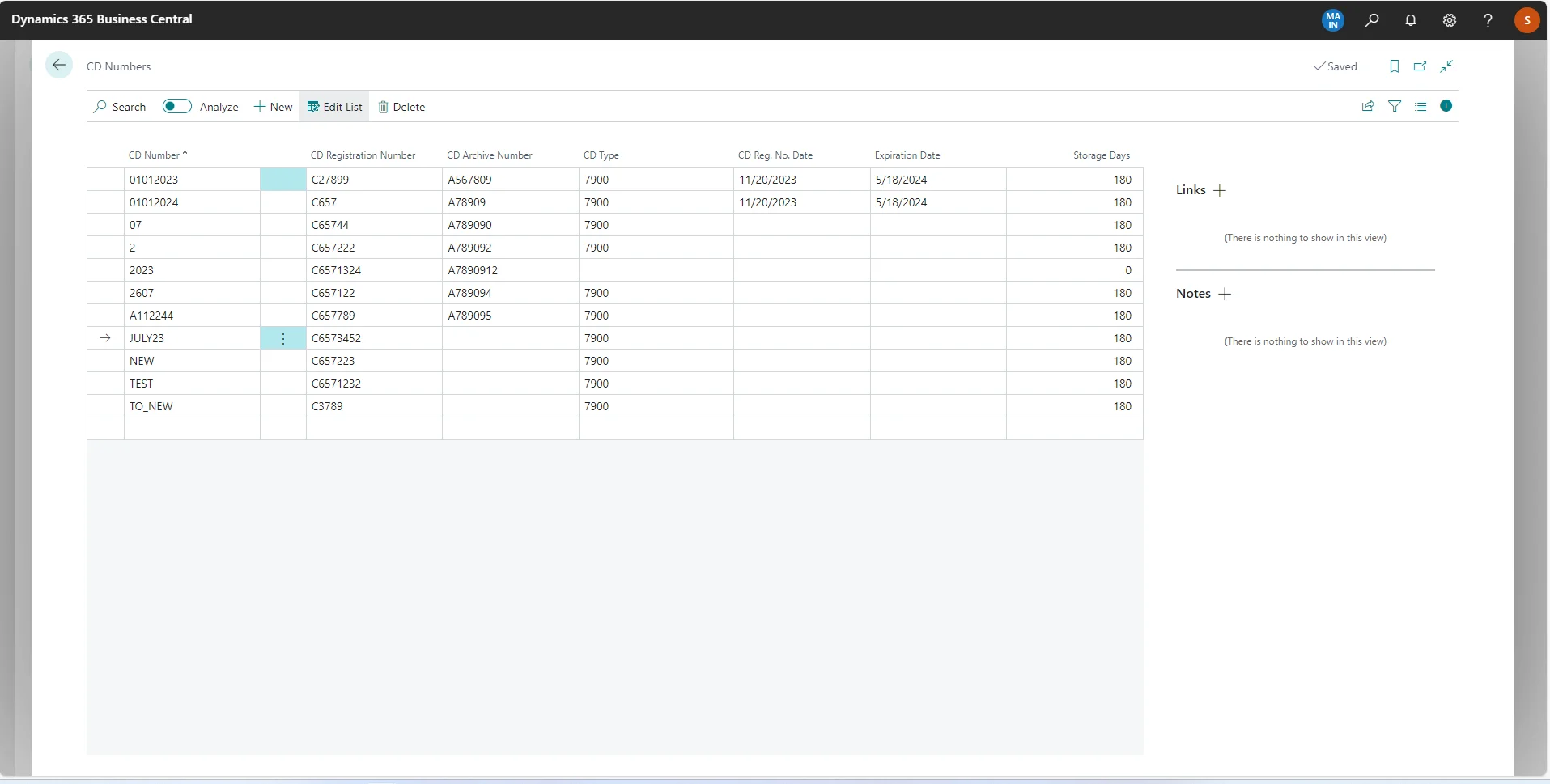

Customs declaration numbers setup

Purchase order document customs declaration and customs declaration header assignment to items

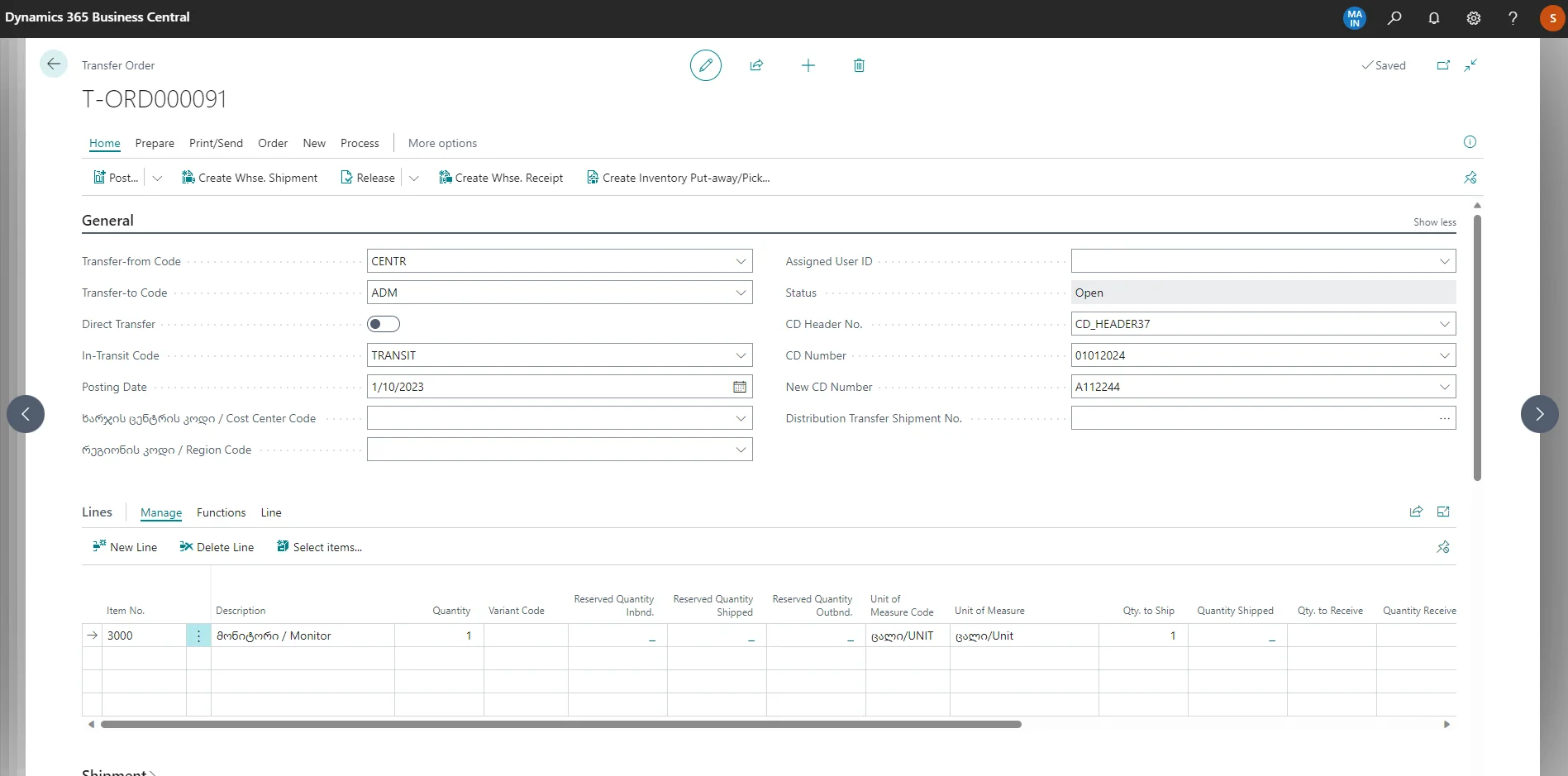

CD and CD Header indication possibility in Transfer Orders

Custom Category Code parameters setup

Preferential certificate setup

Preferential certificate and country of origin setup on an item card

Preferential certificate and country of origin setup on an item card

The main advantages of the solution are the automation of payment and duty calculations, as well as saving time on tracking goods. In addition, the product is easy to use, flexibly adjusts to changes, easily adapts to the requirements of a specific business and fully complies with Georgian tax legislation.

The product is already available on AppSource: appsource.microsoft.com

Have additional questions? Order a consultation of our experts.