SMART business continues to implement new solutions to automate key business processes. Today, we are presenting SMART Cash Flow — a comprehensive tool for effective cash flow management that provides a high level of control over the company’s financial liabilities and cash movement. With this solution, finance departments can make accurate and timely payment planning, which is critical for maintaining the stability of business processes. This tool will be especially valuable for companies that handle large volumes of financial transactions, as the system allows real-time tracking of company transactions, ensuring maximum transparency and control over financial flows.

Features of SMART Cash Flow

SMART Cash Flow helps optimize financial management at key stages: from planning and allocating funds to making payments and analyzing results. The system allows the creation of payment plans for invoices or contracts, facilitates easy editing of amounts and payment dates in the Cash Flow Ledger Entries, and automatically transfers payment data to financial journals. This approach ensures high flexibility and accuracy in managing payments, reducing the need for manual data entry and improving the efficiency of the company’s financial operations.

SMART Cash Flow automates the management of all stages of financial processes through its extensive functionality:

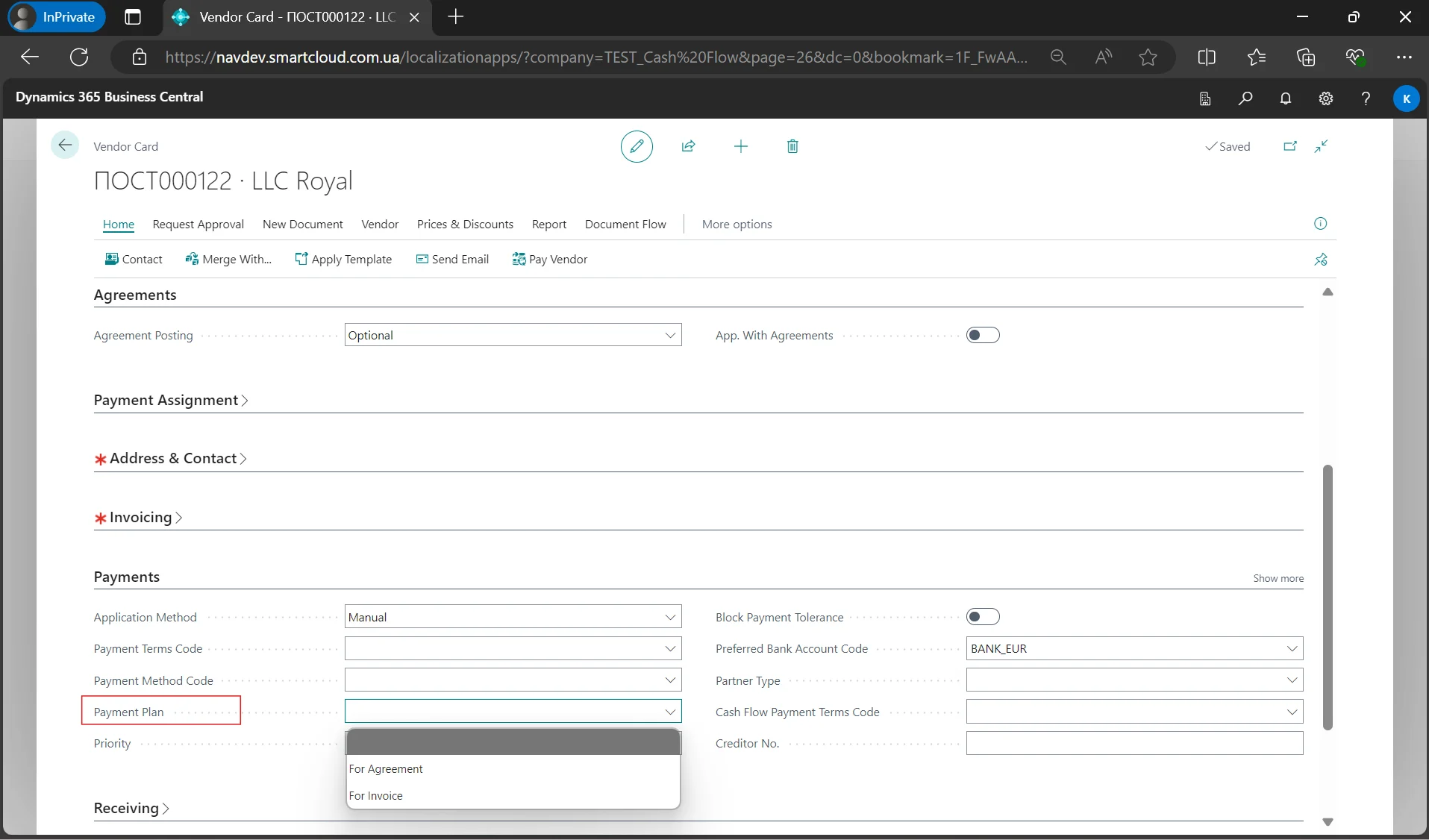

- Payment Plan Setup — the solution automates the process of establishing the necessary payment plan on a vendor, customer or contract card.

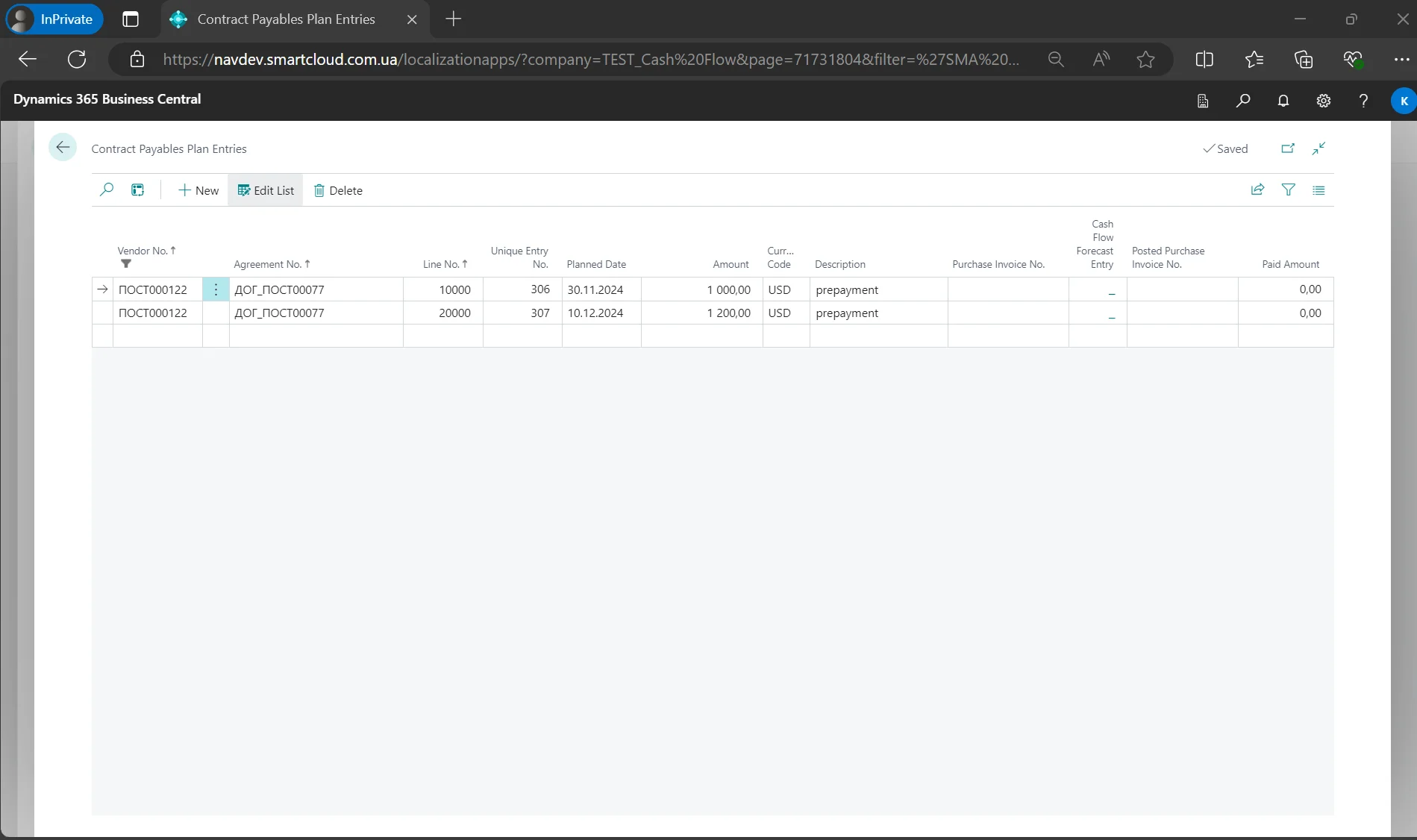

- Creating a contract payables plan — SMART Cash Flow allows you to create Cash Flow Ledger Entries according to the terms of the contract, even when purchase or sales documents have not yet been generated.

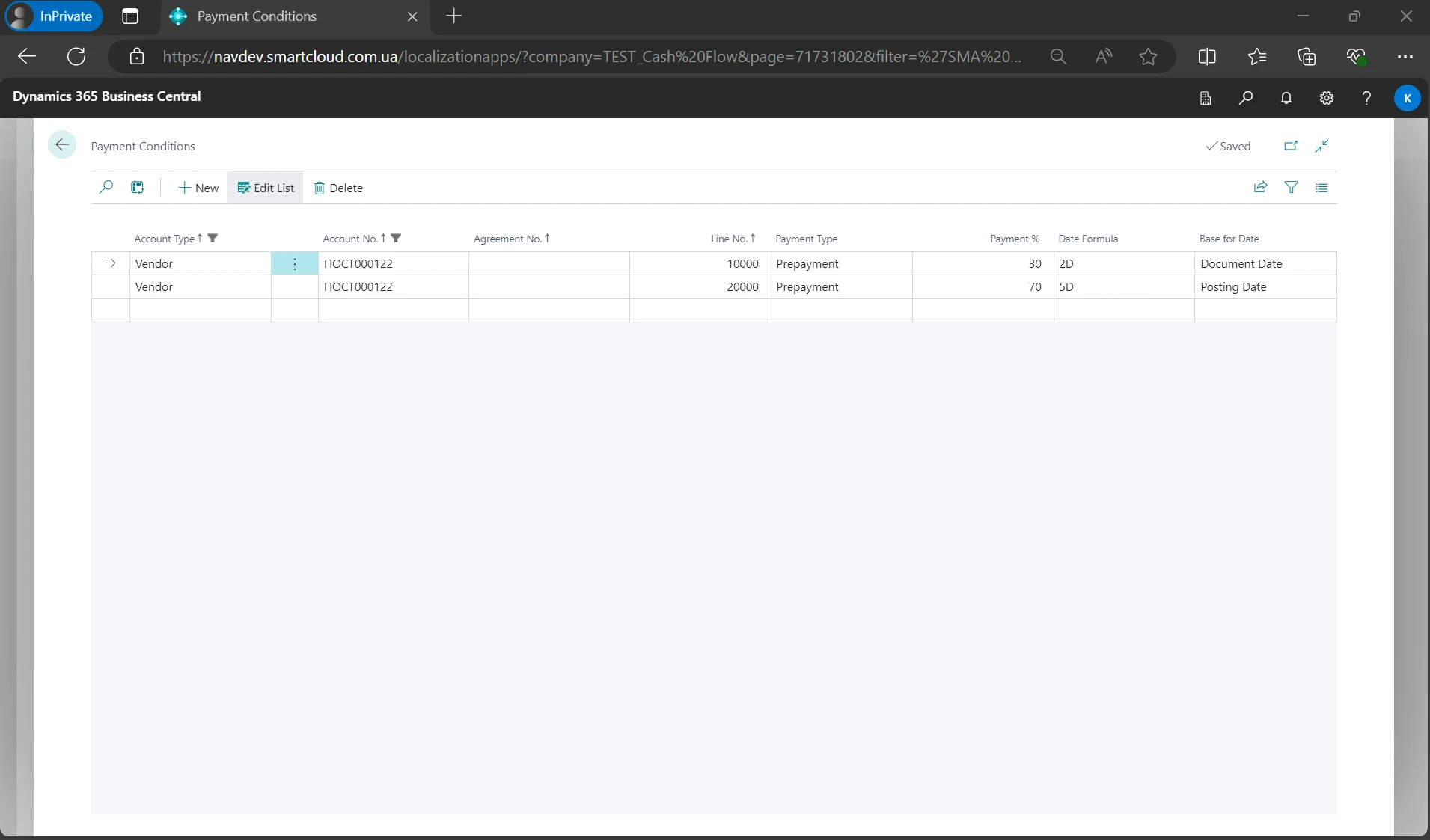

- Creating payment conditions for invoices — When selecting a payment plan for an invoice, the user can define the payment conditions that will apply to each purchase or sales invoice. If necessary, the payment plan for a specific invoice can be adjusted.

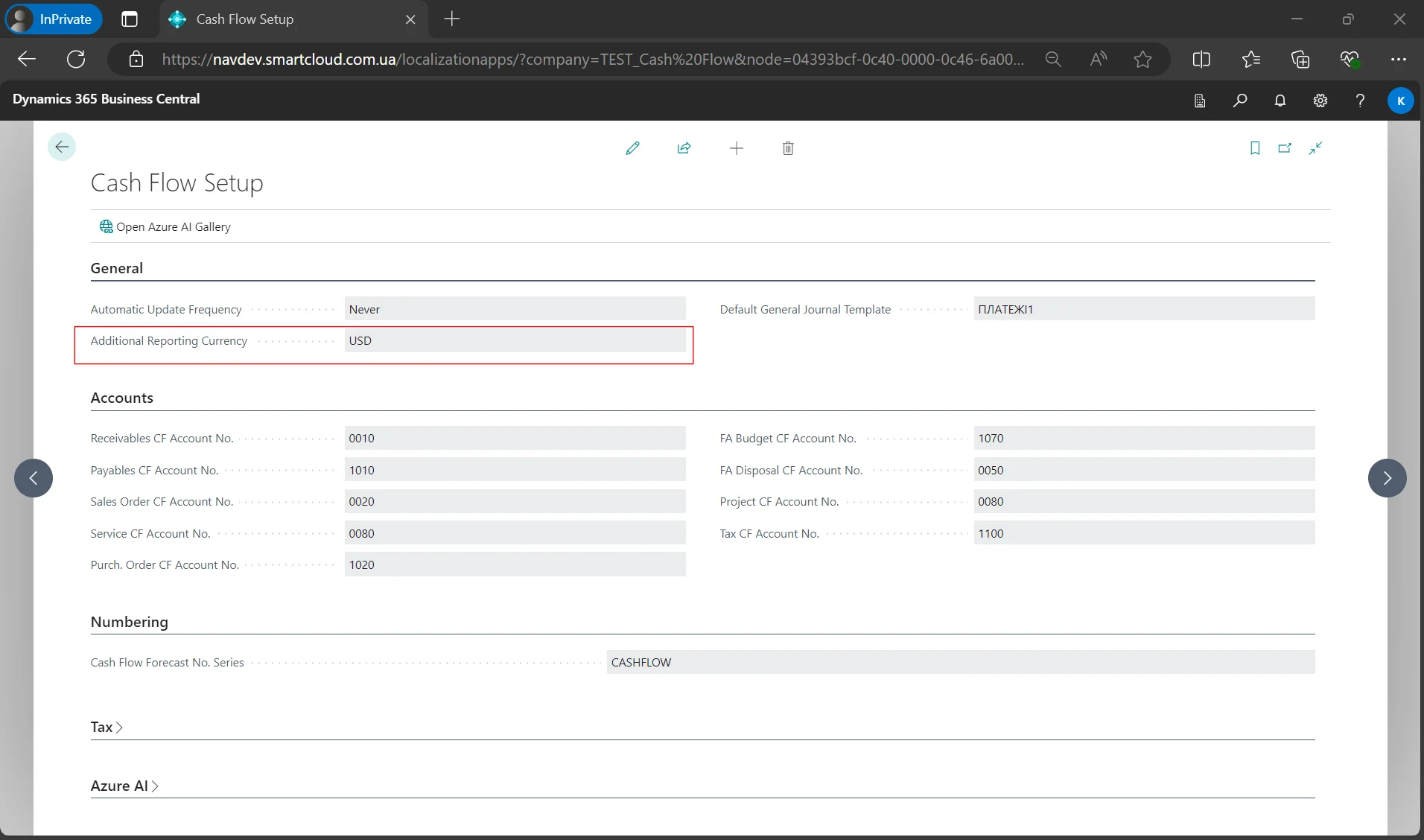

- Displaying Cash Flow Ledger Entries in an additional reporting currency — This solution enables accounting and reporting not only in the company’s base currency (e.g., UAH) but also simultaneously in another chosen currency (e.g., USD or EUR).

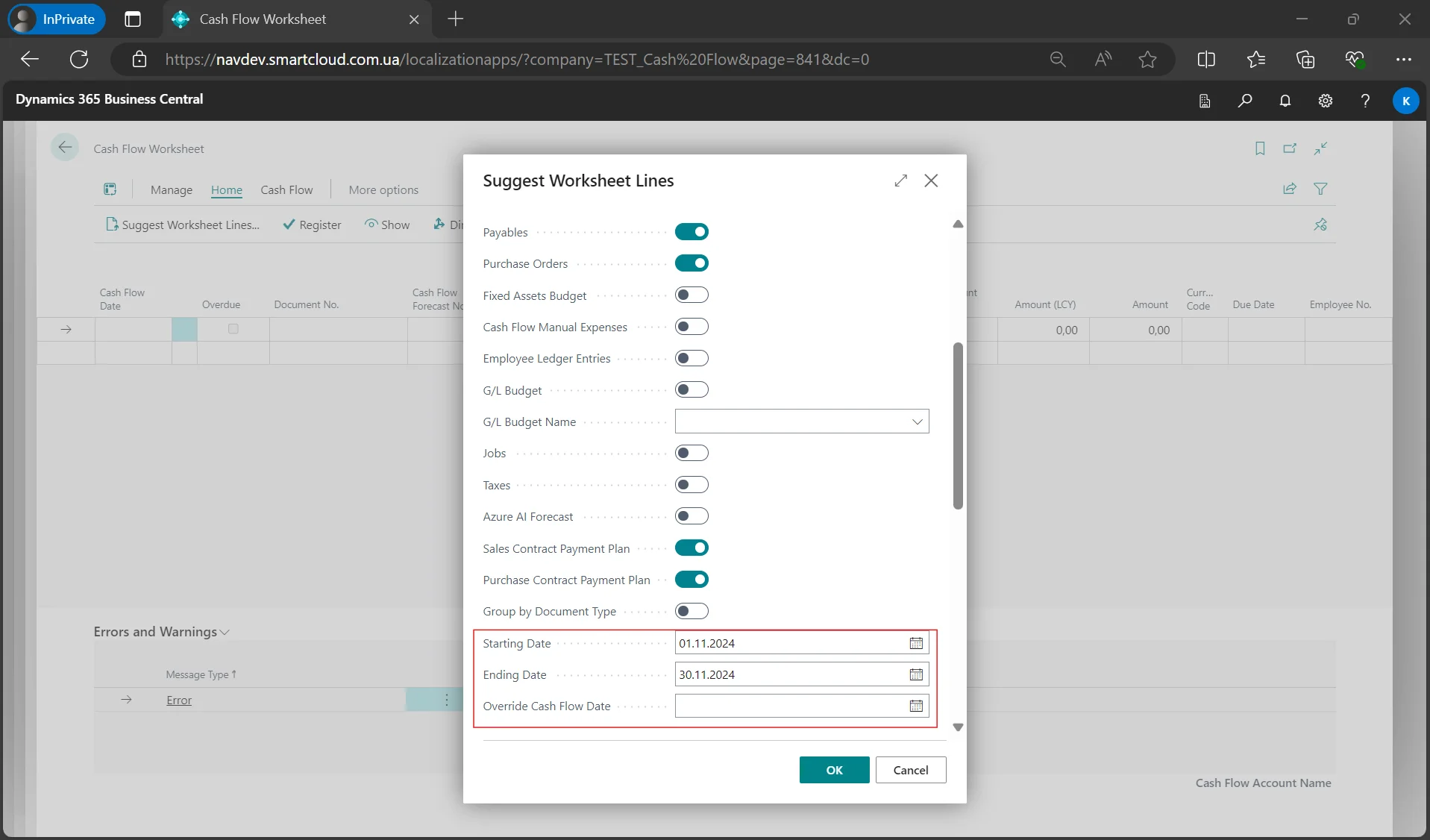

- Setting the period for generating Cash Flow Ledger Entries — When generating entries in the Cash Flow Ledger, the user can specify the exact period for which the Cash Flow Ledger Entries will be created and set a different date for the cash flow movement for these entries, even if they relate to a different period.

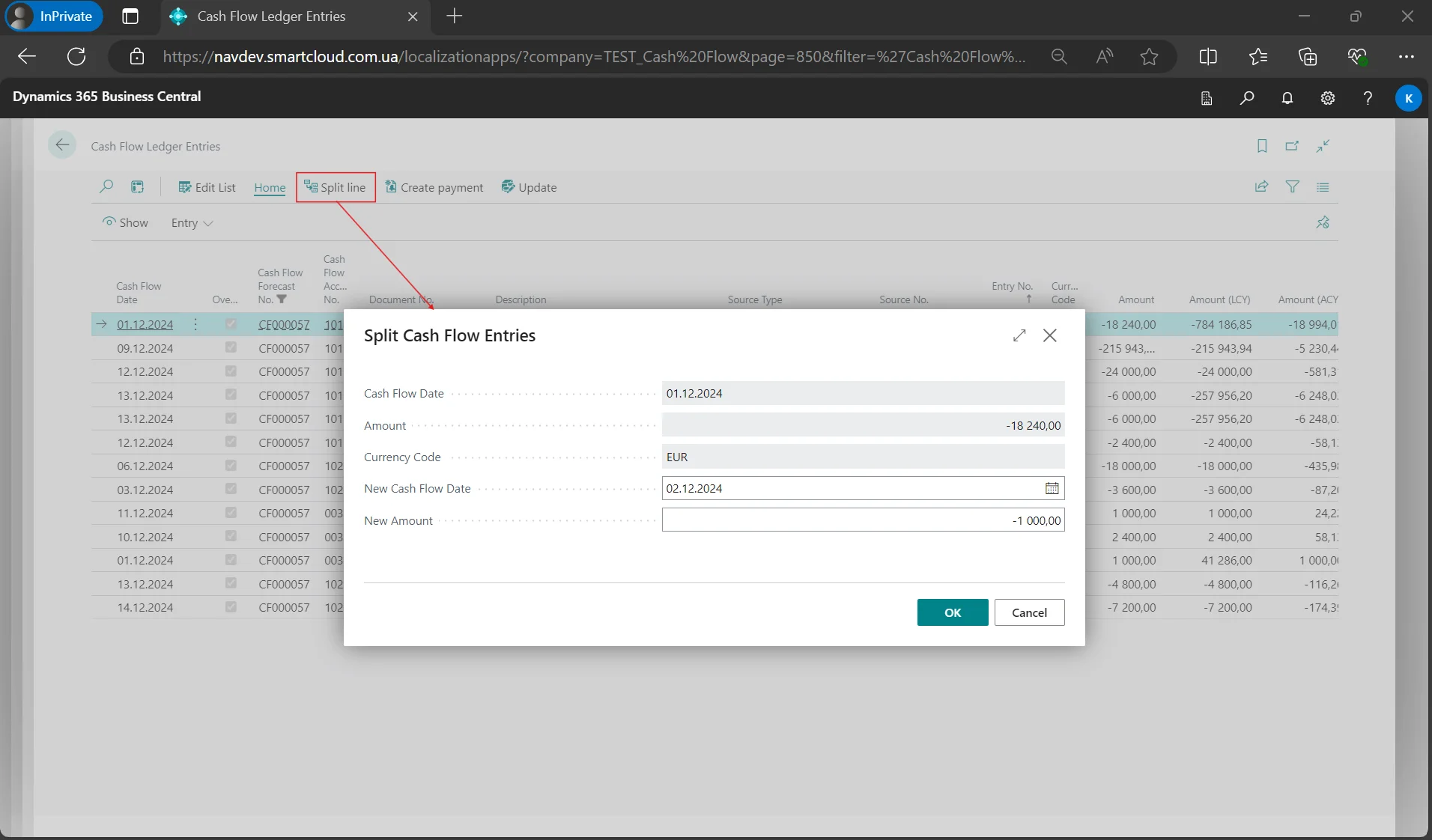

- Splitting Cash Flow Ledger Entry into multiple entries — This functionality allows you to change the amount of an entry by creating additional entries to distribute payments. This means you can take a single entry in the Cash Flow Ledger (e.g., a payment for a certain amount) and split it into several parts by creating additional entries. For example: You have a Cash Flow Ledger Entry — a debt to a vendor for a purchase invoice of 10,000 UAH dated January 15. You decide to pay this invoice in installments, so you split the entry into two parts:

— 6,000 UAH on January 15

— 4,000 UAH on January 31

This can be useful when you need to distribute financial load over multiple periods or adhere to an established budget, ensuring effective cash flow management.

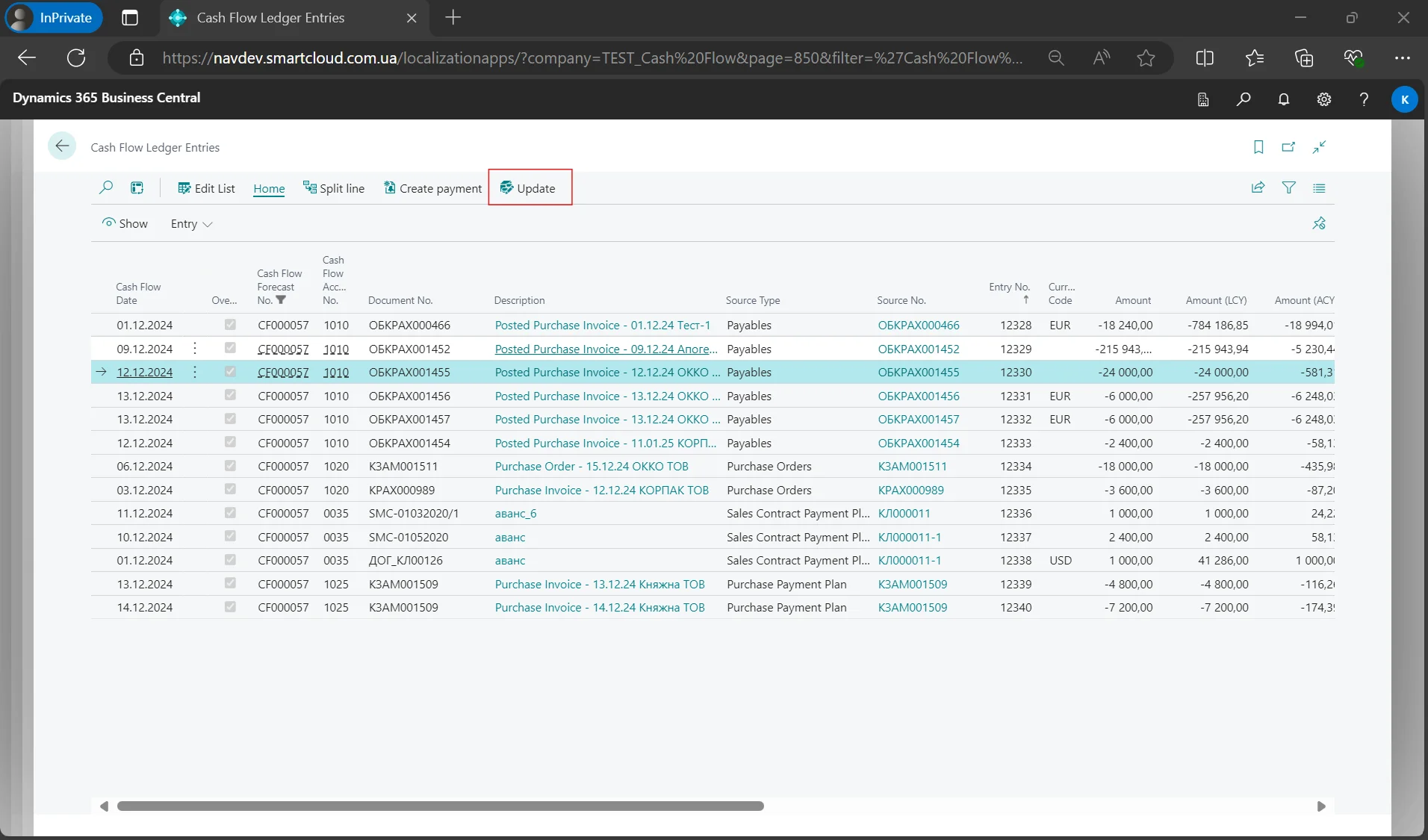

- Automatic updating of data in the Cash Flow Ledger — The solution ensures that dates and amounts of Cash Flow Ledger Entries are updated for non-posted documents when changes are made in the document.

For example: You created a Cash Flow Ledger Entry based on an invoice for 5,000 UAH dated January 10. Later, you made changes to the invoice: the amount was changed to 6,000 UAH or the date was corrected to January 12. Using the “Update” function, the system will automatically update this data in the Cash Flow Ledger to match the latest information from the document.

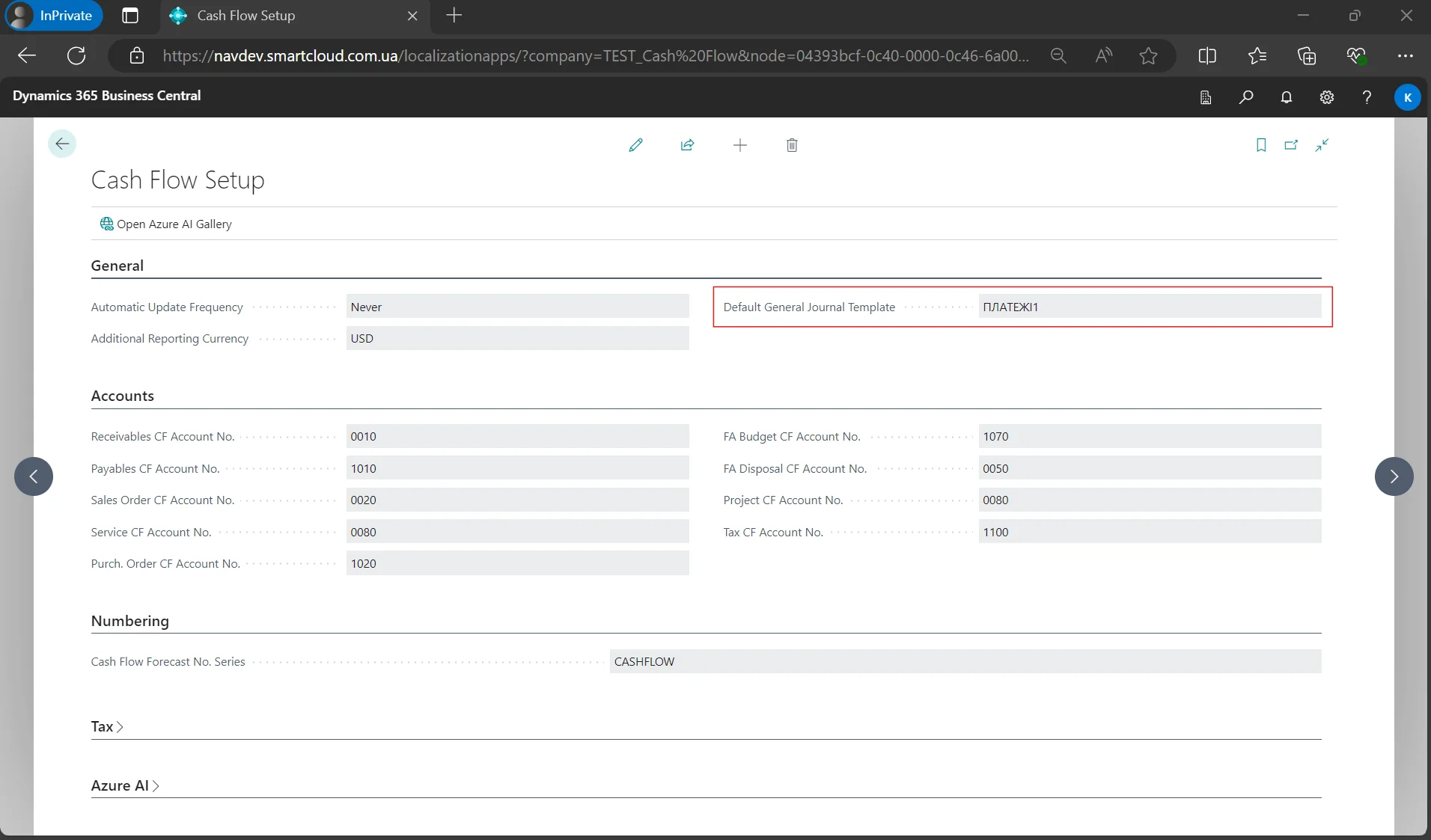

- Setting a default general journal — When creating payments based on Cash Flow Ledger Entries, there is an option to select a default financial journal.

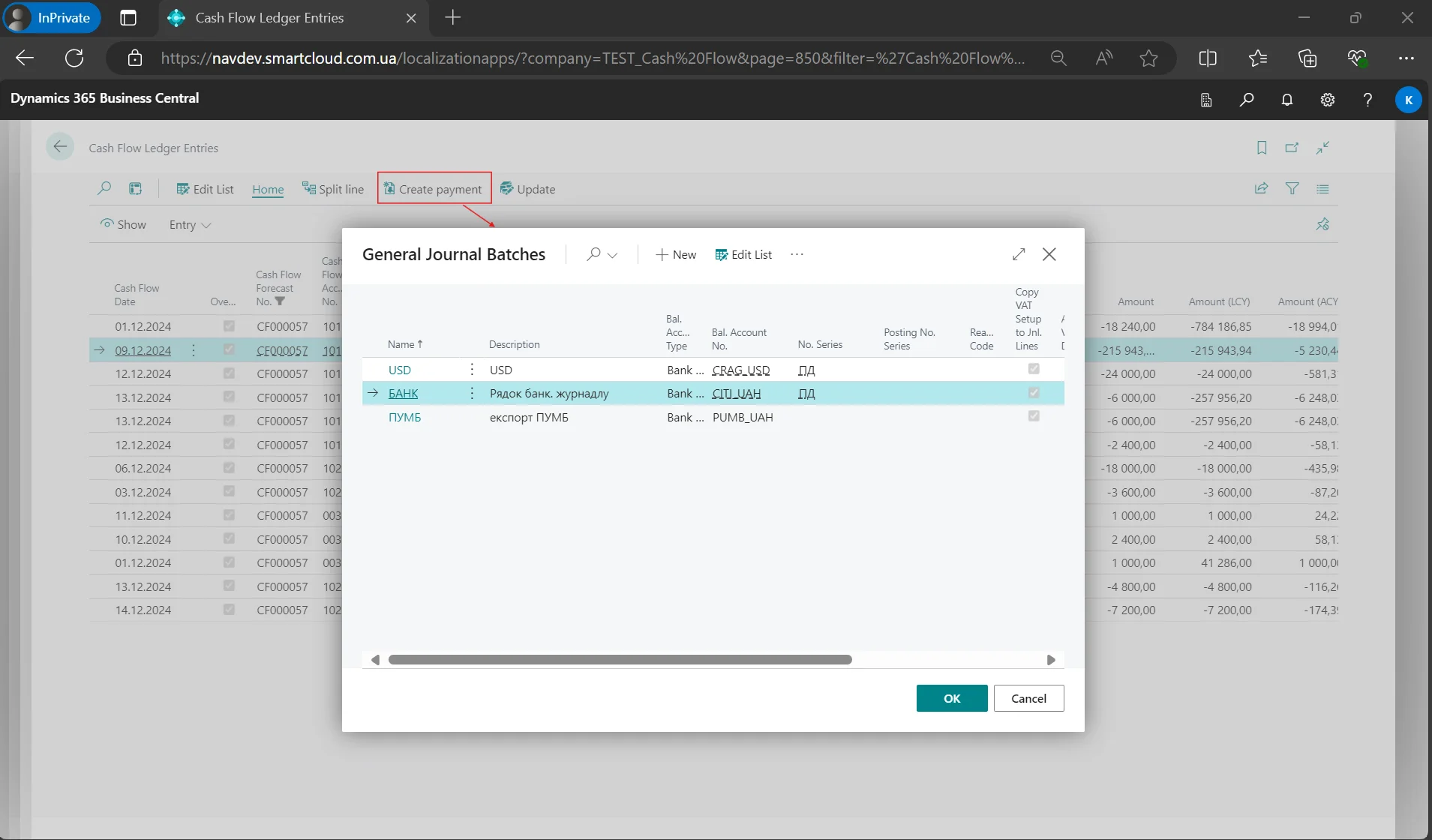

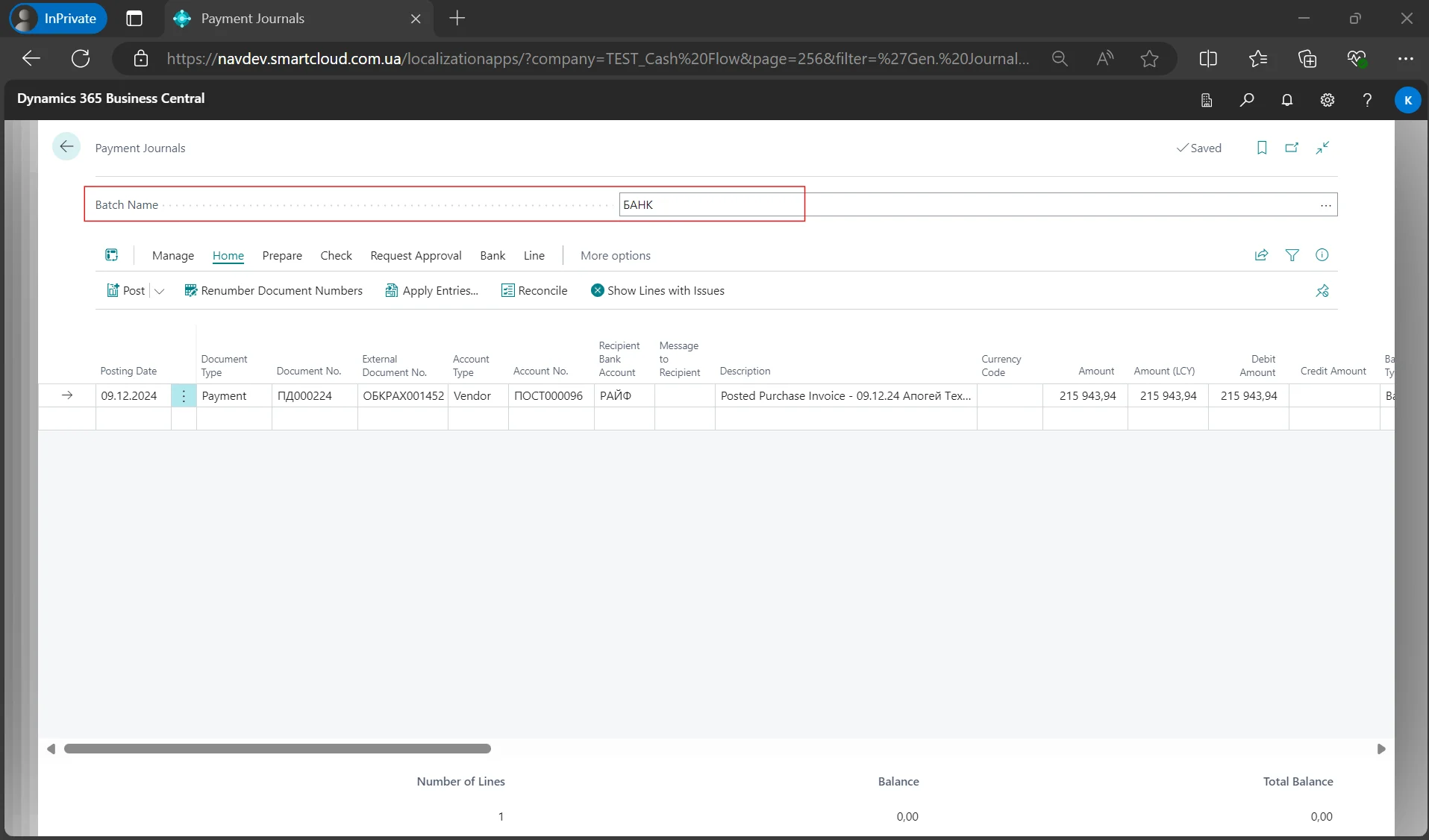

- Automatic payment generation — This functionality ensures the creation of payments based on Cash Flow Ledger Entries and automatically transfers the information into financial journal lines.

Advantages of SMART Cash Flow for managing company cash flows and who can benefit from this solution

The SMART Cash Flow solution will become an indispensable assistant for financial directors who aim to ensure full transparency and control over all stages of the company’s cash flow. Financial analysts will benefit from this solution by being able to form clearer financial plans and receive quality data for analysis. For accountants, SMART Cash Flow automates routine parts of the payment and financial operation accounting processes, while treasury specialists will be able to manage liquidity by automating the creation and integration of payment documents. Auditors will be able to verify the accuracy of financial reports faster, thanks to transparent access to operational data.

SMART Cash Flow meets current market needs by providing the following advantages:

Single database for all processes:

All data is stored and processed within the single Microsoft Dynamics 365 Business Central system, eliminating the need to manually transfer or integrate information from one platform to another. When all processes – ranging from source documents to the creation of the Cash Flow Report – are automated within a single system, the risk of errors caused by human factors or data integration between different platforms is reduced.

Creating a payment plan by invoices or contracts:

The solution allows you to create a payment plan with details for specific invoices or contracts. This ensures more accurate control over liabilities and enables detailed analysis of cash flow and payment status.

Editing amounts and dates in Cash Flow Ledger Entries:

The solution allows you to adjust the amount and date of an entry in case of changes in payment terms. Additionally, you can split the amount of an entry into multiple parts, even if the entries have already been created in the Cash Flow Ledger. This provides flexibility in reflecting the actual payment status.

Creating payments based on Cash Flow Ledger Entries:

When selecting entries for payment, the system automatically transfers all necessary data into the lines of the chosen financial journal. This minimizes the need for manual data entry, increases work accuracy, reduces the risk of incorrect data entry, and optimizes payment processes.

The SMART Cash Flow solution is aimed at fully automating and organizing financial business processes. The transparency of cash flow increases customer trust in the company, while the automated control of payment planning prevents human errors and process inaccuracies. The level of control offered by SMART Cash Flow ensures the stability of the company’s finance department, and the regular releases of the solution guarantee that its functionality will always meet the current market requirements.

The solution is already available on AppSource: appsource.microsoft.com

Have additional questions? Request a consultation from our experts:

Request Consultation