Introducing SMART Localization for Cyprus, a SaaS product that extends the core functionality of Business Central to automate standard tasks associated with operating and managing a business in Cyprus. The solution is developed taking into account local accounting features and legal requirements.

SMART Localization for Cyprus can be useful for both public and commercial companies.

How does it work?

SMART Localization for Cyprus is based on Microsoft Dynamics 365 Business Central. The primary goal is to automate the recalculations and adjustments of VAT transactions based on the customs exchange rates in compliance with local regulations, as well as to facilitate the generation of VAT declarations.

Product’s functionality makes it possible to build more automated, easily controlled and verified accounting, reporting and financial management processes in the system.

SMART Localization for Cyprus provides the following benefits:

- Diverse functionality and flexibility of the system

- Process automation

- Increased business productivity

- Compliance with the requirements of Cyprus legislation

- Flexible operational reporting

- Pre-installed ready-to-use VAT declaration

- Continuous improvements based on customer feedback

Functional capabilities:

- Import of exchange rates from the European Central Bank

- Pre-configured chart of accounts and accounting policy

- Possibility of integration with banks

- Recalculation of VAT entries at the customs rate

- Generation of a VAT declaration

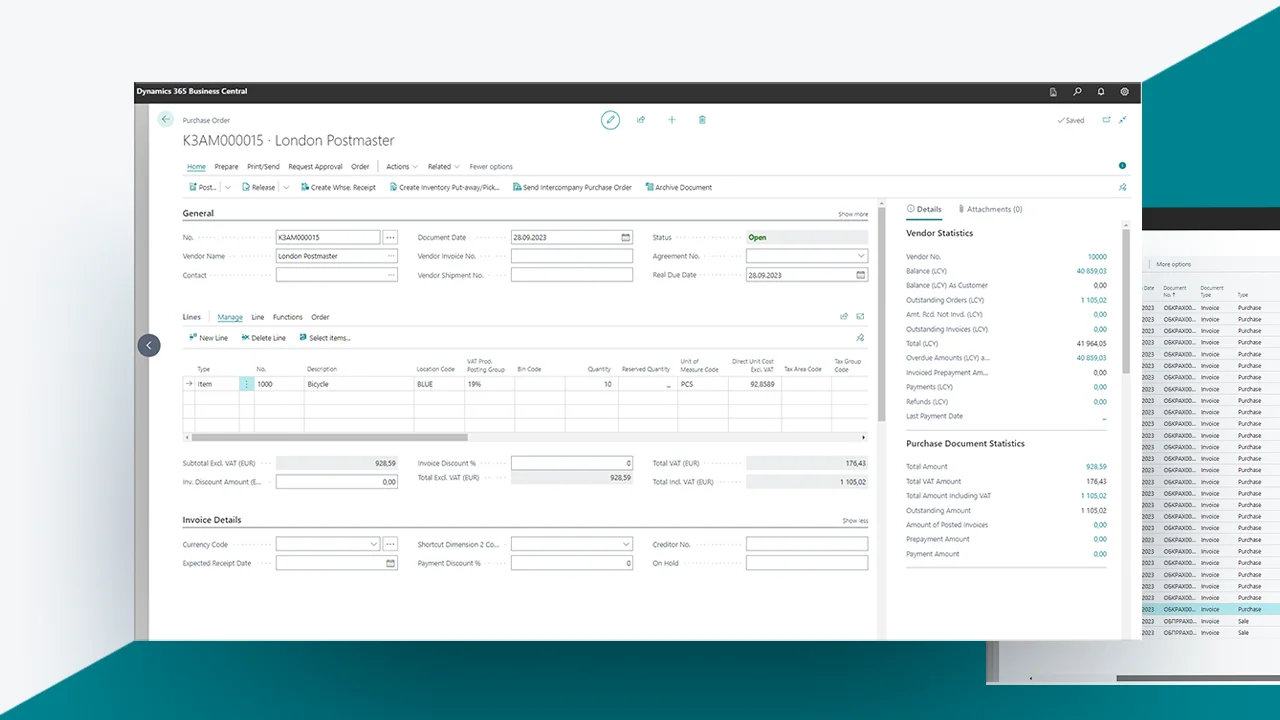

Purchase Order with local vendor including VAT amount

VAT entries with additional information about order

VAT Return (declaration) in the system

SMART Localization for Cyprus powered by Microsoft Dynamics 365 Business Central is developed in accordance with Cyprus tax laws, complying with local accounting standards and methodology. The product is already available on AppSource: appsource.microsoft.com

Have additional questions? Order a consultation from our experts.