SMART business continues to develop tools that enhance the functionality of the Microsoft Dynamics 365 Business Central ERP system. Today, we present SMART IFRS16 Leasing, a solution designed to automate the management of land, vehicle, and property leases. This software enables lessees to efficiently handle all aspects of lease accounting, minimizing the risk of human errors while significantly increasing the accuracy and speed of data processing. By automating key processes such as leasing object card creation, payment scheduling, and contract management, users can streamline their work while reducing the need for manual operations. The solution serves as a universal tool for various leasing agreements, supporting not only monetary but also non-monetary payments.

Key Features of SMART IFRS16 Leasing

The primary advantage of SMART IFRS16 Leasing is its comprehensive functionality, which includes lease right-of-use calculations. This covers the management of land, vehicles, and real estate use rights under lease agreements, ensuring all contractual aspects are accounted for. The software enables users to track and manage both long-term and short-term lease liabilities, arising under the lease contracts.

Regarding payment calculations, SMART IFRS16 Leasing automatically generates lease payment schedules based on contract terms. This significantly simplifies the process of calculating lease expenses for companies, reduces the risk of errors, and ensures financial data accuracy. Moreover, the solution is fully compliant with the International Financial Reporting Standard 16 (IFRS 16) “Leases”, ensuring transparent and accurate financial reporting that aligns with global accounting standards.

SMART IFRS16 Leasing ensures automation of key lease management stages through the following functionality:

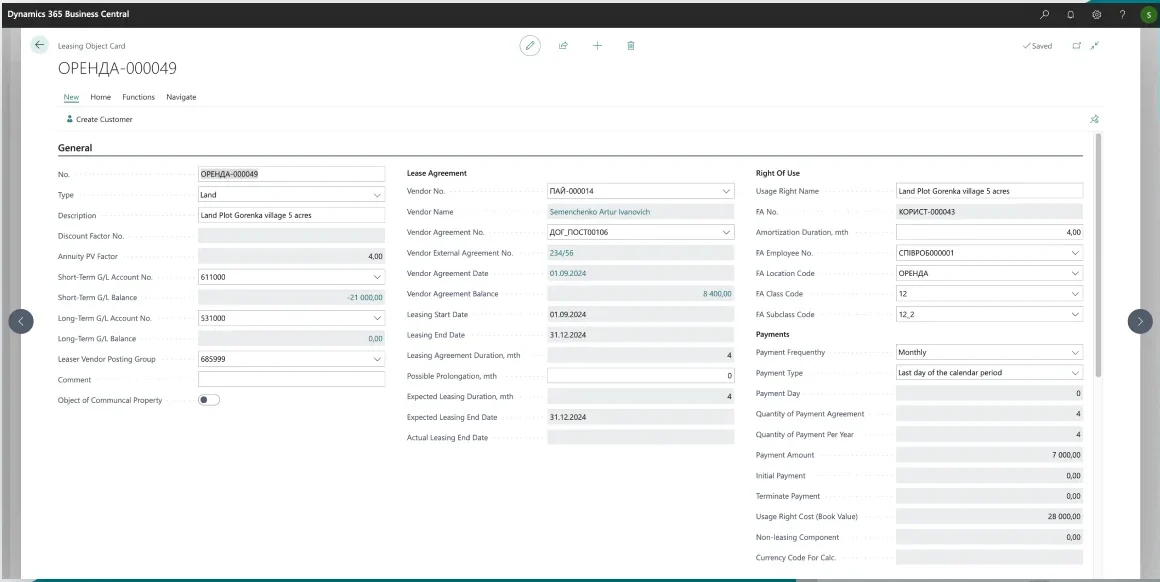

- Creating a Leasing Object Card — The solution allows users to register all key parameters of a leased asset within a single card, including lease terms, financial and accounting data, and discount factors.

Example of a Leasing Object Card:

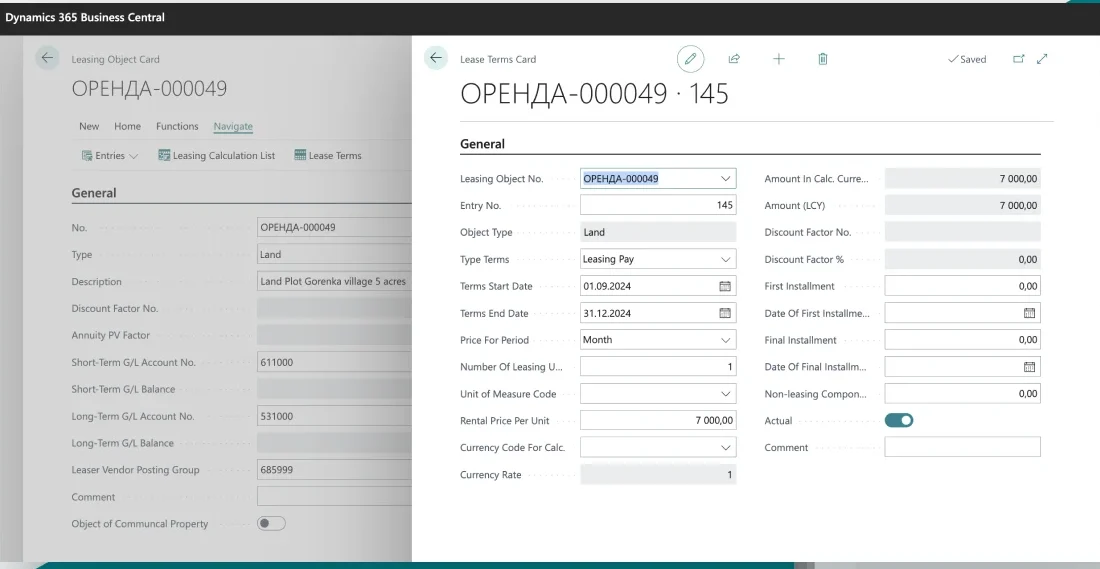

Example of a Lease Terms Card:

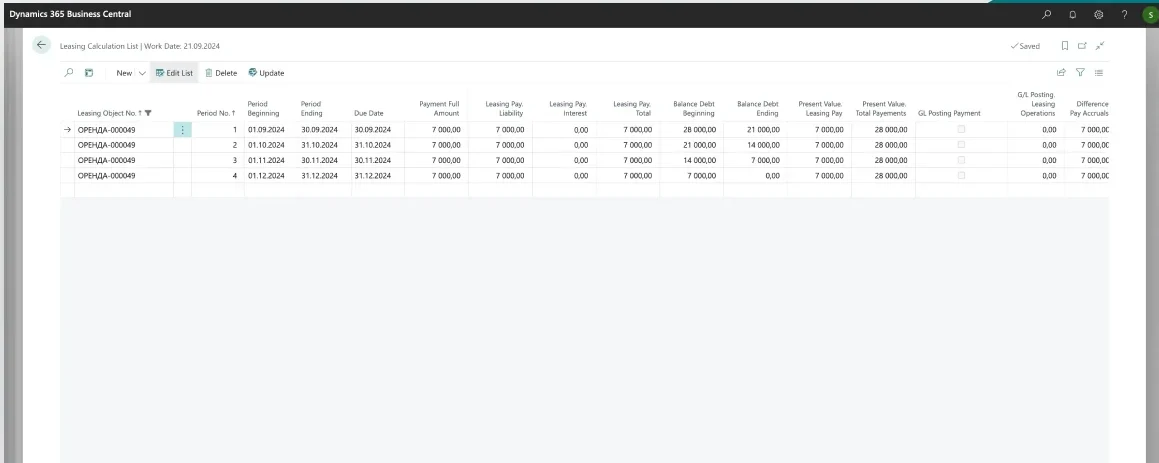

- Automatic Calculation of Monthly Lease Payments – The system ensures precise lease payment calculations by considering contract terms, discounting, currency exchange rates, and indexation adjustments.

- Calculation of Long-Term Liabilities and Leased Object Use Rights – The solution determines the initial value of the asset use rights and the corresponding long-term lease liabilities based on contract terms and discount rates, ensuring full compliance with IFRS 16.

- Reclassification of Long-Term Liabilities into Short-Term Liabilities – The system automatically reclassifies a portion of long-term liabilities into short-term ones on a monthly basis or according to a set schedule, simplifying future payment accounting and ensuring accurate financial reporting.

- Monthly Lease Expense Recognition and Payment Generation – The solution automatically calculates lease expenses according to the payment schedule, generates accounting entries, and ensures consistency in financial records.

- Recognition of Lease Payments in Non-Monetary Form and Offsetting Transactions – The system accounts for lease payments made in the form of goods, services, or other assets and automatically processes offset transactions between parties, reducing manual calculations and ensuring transaction transparency.

- Closing of the Accounting Period – The system locks all recorded lease transactions for a specific period, preventing modifications and ensuring the accuracy of financial statements.

- Lease Agreement Termination or Closure – The solution automates necessary financial operations in the event of lease termination or contract expiration, including stopping right-of-use amortization and adjusting lease liabilities accordingly.

- Adjustments or Revaluation of Assets Use Rights and Long-Term Liabilities in Case of Lease Terms Modifications – The system automatically reviews calculations and adjusts the balance sheet value of the assets use rights and liabilities in response to lease contract changes (e.g., extensions, rate changes, or payment adjustments), ensuring the accounting data remains up to date.

Advantages of SMART IFRS16 Leasing for Lease Management and Who Can Benefit from This Solution

SMART IFRS16 Leasing is a valuable tool for lease managers, providing a single, convenient platform for monitoring contracts, deadlines, payments, and lease term modifications.

For accountants, the system automates lease payment calculations, generates accounting entries, tracks obligations, and performs asset revaluation, minimizing manual operations and reducing human error. For chief accountants, SMART IFRS16 Leasing ensures compliance with IFRS 16, facilitates accurate financial reporting and auditing, helps mitigate financial risks, and enhances lease portfolio management efficiency.

SMART IFRS16 Leasing covers the modern lease management needs through the following benefits:

- Integration with Microsoft Dynamics 365 Business Central – The solution is installed in the Business Central environment, allowing businesses to fully leverage ERP system capabilities, ensuring seamless workflow integration with other business processes and data.

- Full Process Automation – The app eliminates the need for manual lease accounting operations, minimizing errors, saving time, and increasing operational efficiency.

- Accurate Lease Payment Calculations – SMART IFRS16 Leasing automatically calculates lease payments, simplifying financial workflows and ensuring error-free transactions.

- IFRS 16 Compliance – The solution fully aligns with IFRS 16 “Lease” standards, ensuring transparent and accurate accounting in accordance with international norms.

SMART IFRS16 Leasing is designed to maximize automation and streamline lease management processes. Transparent tracking of lease assets and liabilities enhances financial control, while automated payment and liability calculations help eliminate human errors and inaccuracies. The level of control offered by SMART IFRS16 Leasing ensures financial management stability, while the solution’s flexibility guarantees its adaptability to changing market conditions.

The product is already available on AppSource: appsource.microsoft.com

For users in Ukraine, SMART IFRS16 Leasing is adapted to comply with local legislation, including the generation of the Tax Declaration for Single Tax Payers (Group 4): appsource.microsoft.com

Have additional questions? Request a consultation of our experts: