Today, Czechia is a country with an EU-integrated economy, demonstrating stable growth and a dynamic small and medium-sized business sector. As forecasted by the Czech Ministry of Finance, the country’s GDP is expected to grow by 2.3% in 2025, significantly exceeding the 1.1% growth recorded the previous year. Another factor contributing to the country’s economic attractiveness is active government support. At the beginning of 2024, the government approved the creation of the State Investment and Development Agency (SIRS). Additionally, in 2024, a new Economic Strategy was adopted, comprising over 150 measures related to legislation, financing, collaboration with the business sector, and capital markets.

With its economic stability, advantageous location, and strong government support, Czechia presents significant opportunities for businesses looking to expand – provided they are ready to invest in modern solutions and adapt to international standards. However, as the saying goes: great opportunities come with great challenges! To simplify business operations in Czechia, Microsoft has developed a Czech localization for Dynamics 365 Business Central, which is fully adapted to the country’s regulatory requirements and considers taxation, accounting, and other legal norms, as well as local business practices.

As an experienced Microsoft partner in implementing this ERP system, SMART business invites you to explore the functionality provided by the Czech localization and evaluate whether the system meets both general and specific business needs in Czechia.

Functional Features of the Czech Localization for Business Central: From Regulatory Compliance to Powerful Business Tools

The Czech localization for Dynamics 365 Business Central is a comprehensive solution that integrates automation of regulatory requirements with advanced functionality to optimize key business processes.

Automation and Compliance with Local Financial Regulations

- Support for adjustment transactions (Red Storno) enables automatic application of adjustment rules for transactions such as inventory counting and fixed asset accounting.

- The Czech localization automates the processing of accounting documents, including turnover reports, open entries in the general ledger, and inventory balances.

- Adaptation to the Czech National Bank’s standards allows for automatic exchange rate updates, ensuring accurate accounting of foreign currency transactions.

- Multi-ledger accounting enables transactions to be distributed across different accounting layers – financial, managerial, and off-balance-sheet accounting – offering greater flexibility and compliance with local reporting requirements. This functionality is particularly useful for businesses applying accounting policies that differ from local standards.

- The Czech localization includes updated designs for printed documents, ensuring compliance with local regulatory standards.

Optimization of Tax and Statistical Reporting

- The Czech localization of Dynamics 365 Business Central provides built-in support for key tax reports, including the VAT Statement, Supplementary VAT Statement, VAT Control Statement, and VIES Report. The system offers a fully integrated solution for generating and submitting tax reports that comply with EU regulations.

- Reports allow for custom calculations, data filtering by VAT date, and consideration of triangular trade scenarios within the EU market.

- The system enables exporting reports in XML format and attaching comments or supplementary documents for submission to tax authorities.

- The exchange rate for VAT calculations in documents can be adjusted, ensuring compliance with local regulations regarding transactions conducted in foreign currencies while accounting for local currency requirements.

- The Non-Deductible VAT for Czech function applies a tax credit reduction coefficient to purchase transactions. If a company uses taxable vendors for both tax-deductible and non-deductible operations, the input VAT is reduced according to a predefined coefficient. This coefficient can be configured at the company level and is automatically applied to relevant transactions. At the end of the fiscal year, the system recalculates VAT entries based on the actual coefficient and applies necessary adjustments.

- The Unreliable Payer function in the Czech localization helps businesses verify a vendor’s status in the Unreliable VAT Payers Register, as defined by Czech Law 235/2004. Additionally, the system displays officially registered vendor bank accounts, ensuring that payments are made to approved financial institutions.

It’s important to note that Dynamics 365 Business Central allows for generating Intrastat reports for intra-European trade. This feature automates the process of collecting data and generating reports in line with local standards.

Fixed Asset Management: From Acquisition to Reporting:

- Asset Acceptance and Commissioning – The Czech localization provides a two-step process: purchase registration and asset commissioning. When fixed assets are disposed of – whether through sale or write-off – the system automatically adjusts the asset’s residual value and calculates depreciation. The residual value is accurately displayed in the system, ensuring compliance with local standards.

- Tax Depreciation – The system’s tax depreciation calculation functionality ensures compliance with the Income Tax Act (586/1992 §26-§33). It supports different depreciation methods, including straight-line, accelerated, and special methods for intangible assets (depending on the asset group), fully covering the requirements of Czech law.

- Depreciation Break – Czech law allows for suspending depreciation on certain assets for a limited period. The system automatically resumes the depreciation schedule once the break is over, ensuring a seamless user experience.

- Reports and Analytics – The system offers features for generating fixed asset accounting reports, including asset location history and tracking responsible individuals, simplifying auditing and asset management.

Banking Operations and Advance Payments Management:

- Another important aspect of localization is the functionality for banking documents. The localization provides support for SEPA (Single Euro Payments Area) payment export and the processing of bank statements in this same format.

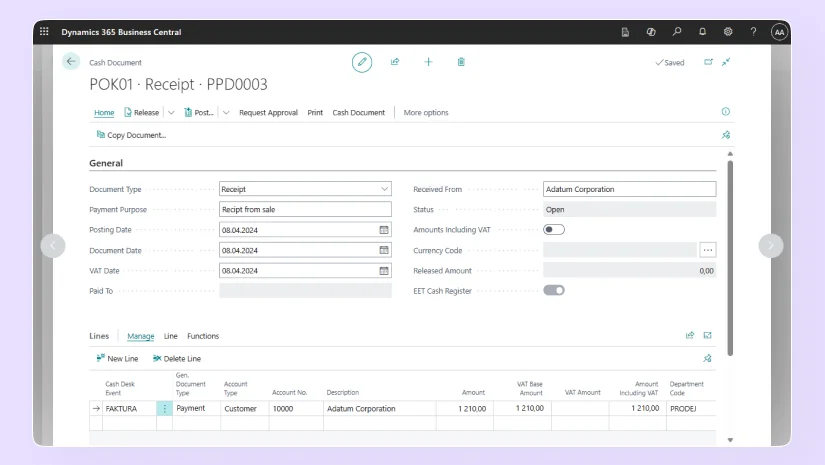

- The Cash module helps set up the accounting of cash operations. Users can configure cash accounts, automate cash receipts and disbursements, and easily generate cash reports.

- Special attention should be given to the Advance Letters module, which helps create letters for received or paid advances. The functionality includes the creation of necessary VAT operations.

Enhanced Currency Exchange Difference Accounting, Offsets, and Counterparty Data Validation

- One of the key features is the currency exchange rate adjustment function for accounts receivable and payable. This allows businesses to handle exchange rate differences separately for customers, vendors, and bank accounts, work in test mode without posting transactions, and choose the method for data transfer.

- Particularly valuable is the improved method for calculating both realized and unrealized exchange rate differences, which complies with Czech tax legislation.

- Another essential part of the system is offsetting accounts receivable and payable. When a customer is also a vendor, the system automates the offsetting process. A special module provides tools for quickly creating and printing offset agreements, calculating balances, and preparing entries for accounting.

- Integration with the ARES system allows companies to obtain up-to-date information about counterparties from the Czech business entity registry and automatically update customer and vendor data.

In addition, the Czech localization of Dynamics 365 Business Central simplifies warehouse accounting with features for splitting accounts to round off inventory values and helps identify accounts for inventory surpluses and shortages.

A particular advantage is the ability to fine-tune permissions for working with warehouse codes, allowing separate management of access to goods receipt and shipment operations. The localization also adds a feature to verify the sequence of actions in warehouse operations, which controls the chronological order of inventory movement transactions. Another important element is the support for inventory transfer and SKU templates. This enables the automation of parameter settings such as ordering policies and replenishment systems, significantly improving inventory restocking efficiency. Another convenient feature is the ability to set up separate accounts for inventory transfer and assembly documents.

Custom Enhancements and Benefits of Implementing Czech Localization of Dynamics 365 Business Central with SMART business

At the same time, when implementing the Czech localization of the ERP system, businesses may face some challenges that require the involvement of an experienced vendor. SMART business has years of experience working with Microsoft’s Dynamics 365 Business Central localizations and deeply understands the specifics of implementing this solution in various regions. Moreover, the company is actively expanding the functionality of the Business Central ERP system within its own Localization HUB direction. This initiative involves developing localized solutions for countries where no localization exists from Microsoft. Even though a Czech localization exists from the developer, SMART business offers not only system implementation services but also provides additional benefits.

For example, the standard functionality of the Czech localization of Dynamics 365 Business Central includes support for payments through SEPA — the international standard used for euro payments between EU member states, the European Economic Area, and some other countries. However, most banks in Czechia use local data exchange formats that are incompatible with SEPA. As a result, integrating Dynamics 365 Business Central with banking systems in Czechia requires additional modifications. To solve this, the SMART business team offers:

- Development of custom functionality tailored to the company’s needs,

- Use of partner specialized solutions for banking integration.

Thus, along with the implementation of the Dynamics 365 Business Central system, SMART business also provides a range of its own solutions that help build an integrated, holistic IT ecosystem. Moreover, relying on deep expertise and years of experience, the SMART business team advises customers on optimal solutions, handles communication with local partners, and ensures that customer requirements are met. The company explores available market options, evaluates their compatibility with the customer’s business processes, and offers the most relevant integration solutions. As a result, this enables companies to optimize costs, save time on technical matters, and focus on developing their business. This approach guarantees that the company will receive a software product that meets not only the general business requirements in Czechia but also the customer’s individual needs!