Managing receivables is one of the key tasks for a company’s financial departments. Delayed payments can lead to cash flow gaps, difficulties in financial planning, and liquidity losses. Given these challenges, SMART business continues to expand its portfolio of solutions based on the Microsoft Dynamics 365 Business Central ERP system, developing new tools to automate financial processes.

Today, we present to you the SMART Reserves solution for creating a provision for doubtful debts – a comprehensive tool that allows businesses to effectively control the process of managing the company’s current receivables.

How Does SMART Reserves Work?

The solution provides end-to-end control over unpaid invoices, deviations from the initial contract terms, automatically calculates the provision for doubtful debts for receivables as of the reporting date, and generates the necessary accounting entries, among other tasks. The main advantage of SMART Reserves is its coverage of the entire process: from analyzing the client’s open transactions to calculating the provision amount. SMART Reserves includes the option to automatically calculate the number of overdue days, the corresponding doubtful debt coefficient, and the provision amount. Additionally, the solution has functionality for integration with accounting systems to reflect the provision in the accounts.

Thus, SMART Reserves integrates the processes of receivables analysis, calculation of the provision for doubtful debts, and reflection in the accounts, ensuring full transparency and the ability to track each transaction. The solution simplifies the accounting of the provision for doubtful debts, allowing companies to minimize financial risks.

Solution Benefits:

- Flexible Adjustment of Doubtful Debt Coefficients for Different Risk Groups – This allows companies to take into account the financial reliability of clients and personalize the approach to managing current receivables. For example, a lower coefficient can be set for reliable partners, while a higher one can be applied for high-risk clients, helping to minimize financial losses.

- The Ability to Save the Generated Document in the System, Containing All Source Data for the Provision Calculation – This ensures that the company always has detailed accrual history at hand, simplifying financial audits, increasing transparency in accounting, and enabling quick verification and analysis of the provisioning processes.

- Automatic Generation of Accounting Entries for the Calculated Provision Amount – This significantly reduces the time spent on processing financial transactions, lowers the risk of human errors, and ensures the correct reflection of the provision for doubtful debts in the financial statements. The accounting department no longer needs to manually create journal entries, increasing the efficiency of accounting.

- Automatic Adjustment of the Provision for Doubtful Debts upon Debt Settlement – The system automatically updates financial indicators upon payment receipt, ensuring that up-to-date information on overdue receivables is always available and preventing unnecessary provisions that could distort the company’s actual financial position.

SMART Reserves Functionality

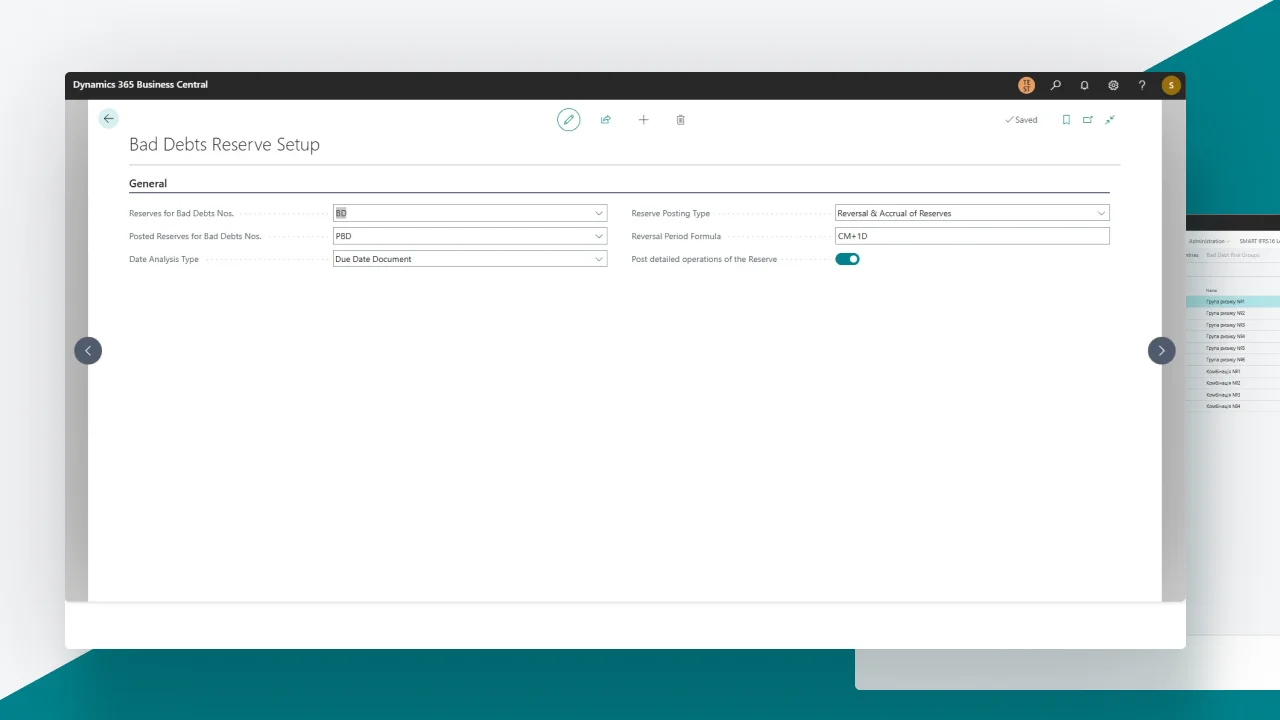

- Functionality for Setting Up the Provision for Doubtful Debts on Overdue Receivables.

Example of the provision setup window for doubtful debts on receivables:

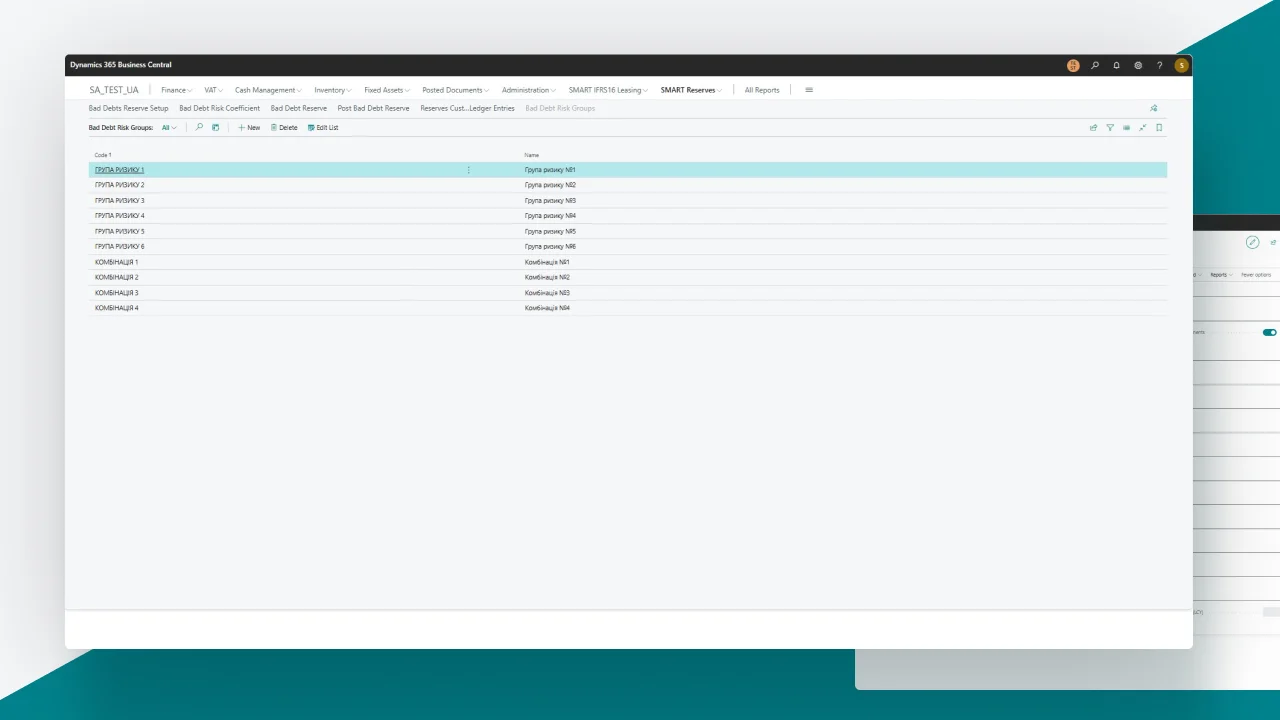

- Functionality for Determining the Risk Group for Buyers: Setting up the risk group for each customer.

Example of the window for setting up risk groups for doubtful receivables:

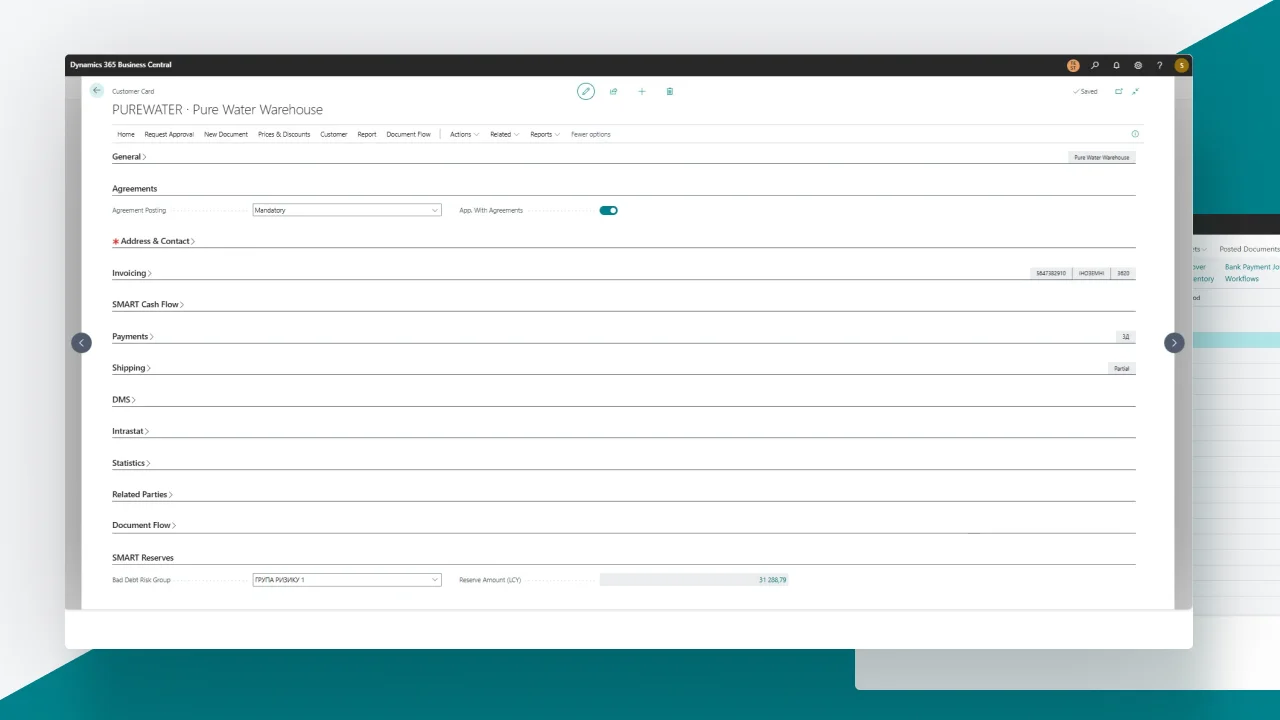

Example of the window for assigning a risk group to a client:

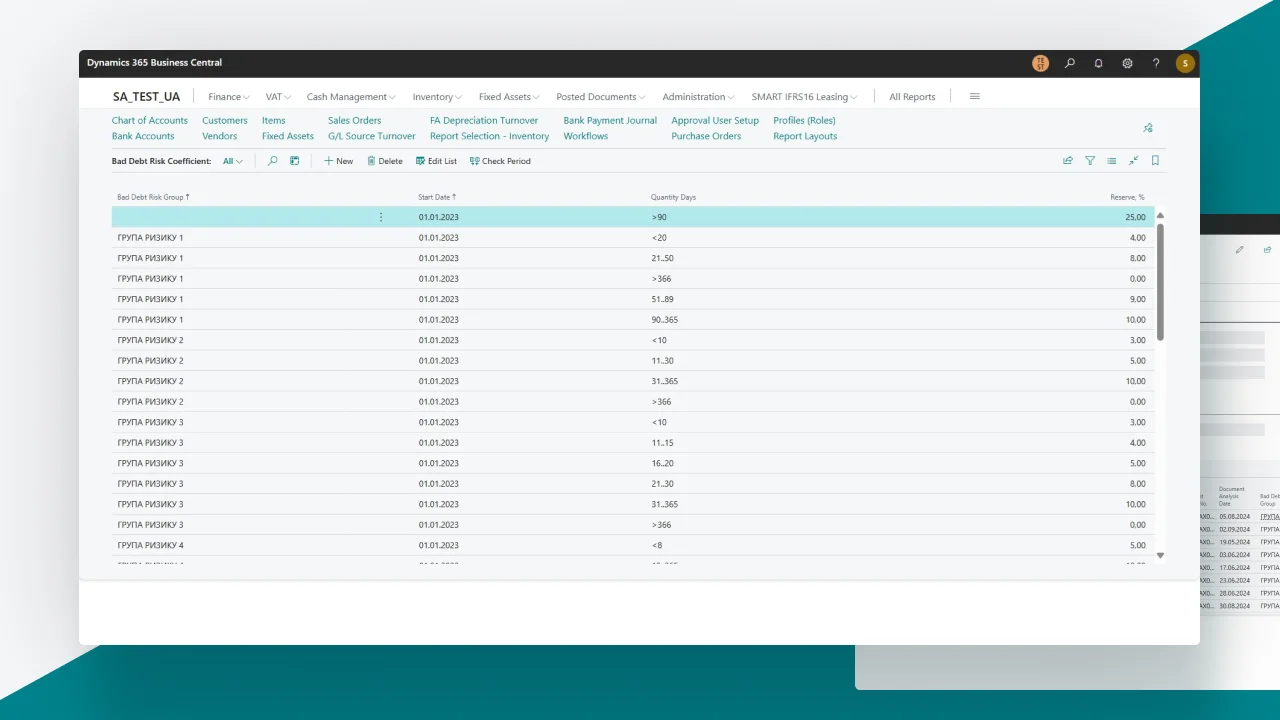

- Functionality for Determining the Doubtfulness Coefficient: Setting the doubtful debt coefficient for each overdue period.

Example of the window for setting doubtful debt coefficient for receivables:

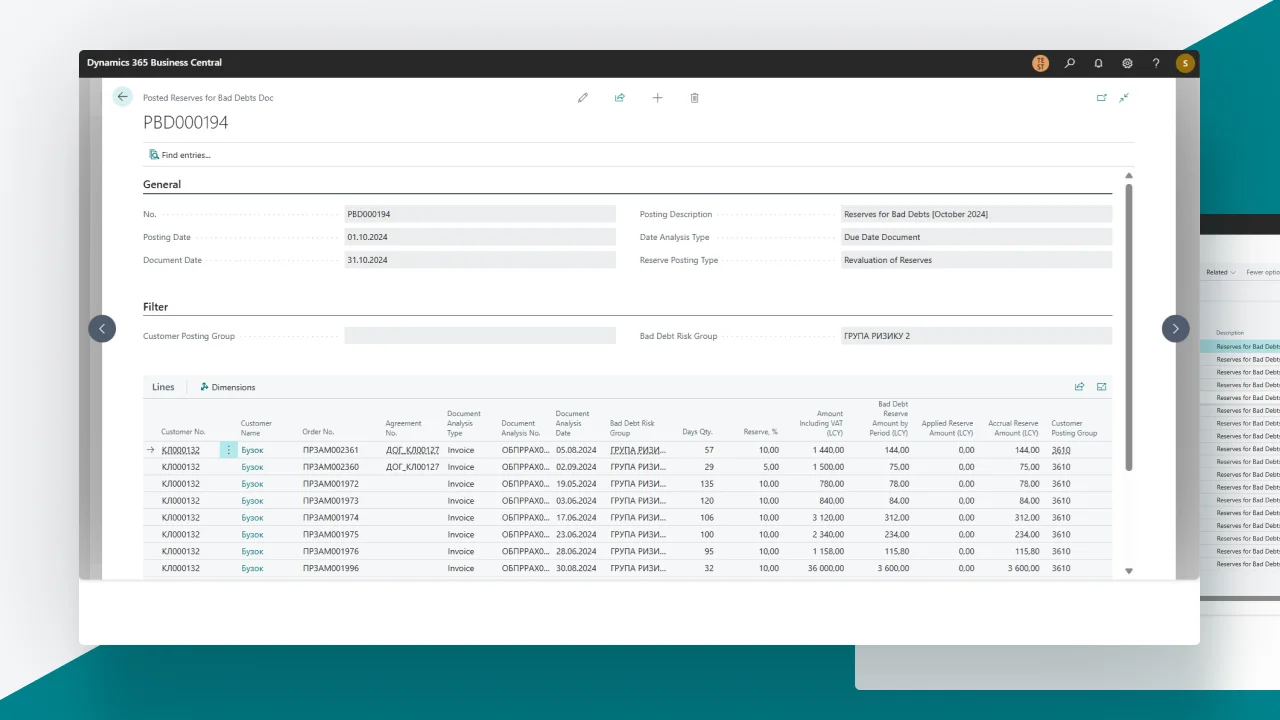

- Ability to Analyze Unpaid Invoices, Calculate Overdue Days, and Calculate the Provision: The document contains a detailed list of unpaid invoices, making it easy to track overdue receivables. SMART Reserves automatically calculates the number of days an invoice remains unpaid and automatically calculates the provision for doubtful debts as of the reporting date.

Example of the provision calculation document for doubtful debts on receivables:

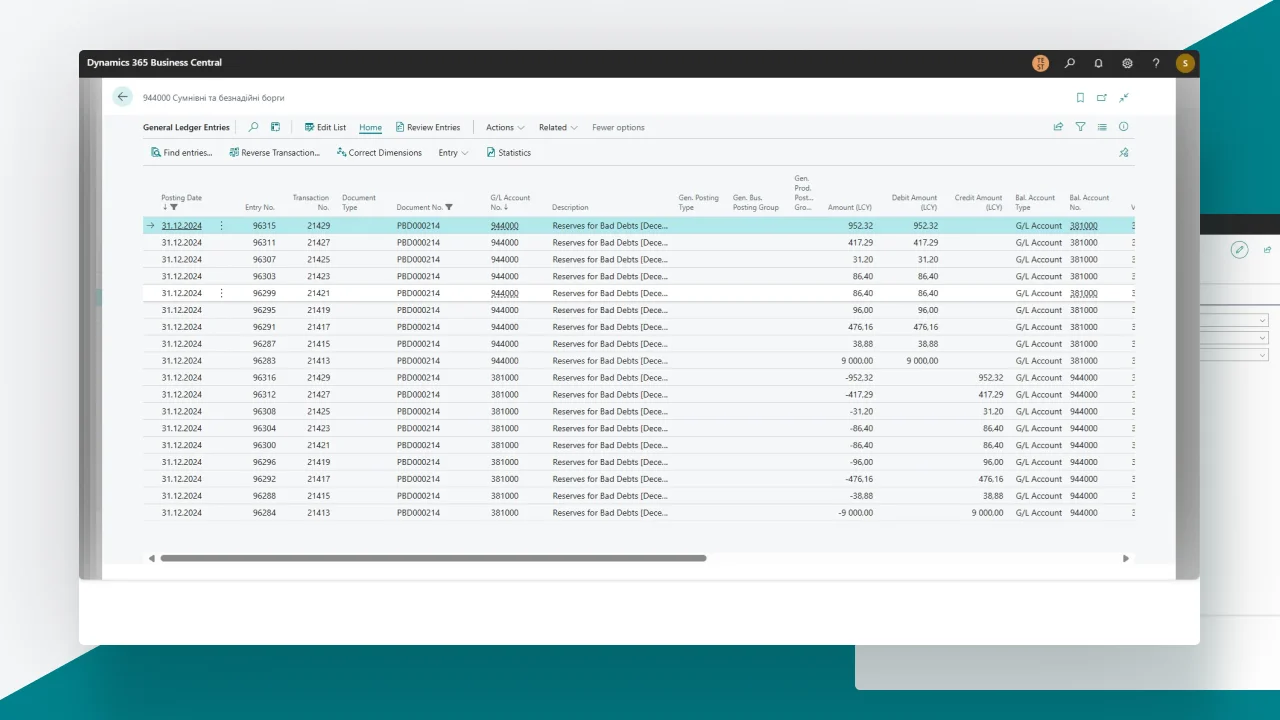

- Functionality for Generating Accounting Entries: Generating accounting entries to reflect the provision for doubtful debts in the accounts.

Example of an accounting entry for the provision of doubtful debts on receivables:

Who Will Benefit from SMART Reserves, and What Is Its Key Value for Business?

SMART Reserves, designed for the creation of provisions for doubtful debts, will become an indispensable tool for CFOs, accountants, and analysts responsible for managing receivables and financial planning. The automation of calculating provisions for doubtful debts on receivables significantly reduces the risk of financial losses, helps to promptly identify problematic debts, and supports informed management decision-making. This is especially relevant for companies operating in the B2B segment, where large volumes of credit transactions require detailed control and cash flow forecasting.

The key value of the solution lies in the ability to proactively manage financial risks. With SMART Reserves, companies gain a transparent mechanism for assessing receivables in accordance with financial accounting standards. Automating the provision calculation process minimizes the impact of human error, ensuring the accuracy of calculations and compliance with the company’s accounting policies.

Additionally, SMART Reserves will be beneficial for companies with a large portfolio of clients who need an effective tool for quickly assessing the financial condition of counterparties. The solution allows flexible adjustment of the doubtfulness coefficients for different customer categories, adapting the calculation to the specifics of the company’s business model. This approach not only helps to manage financial risks but also contributes to enhancing the financial stability of the business in the long term.

The SMART Reserves solution is already available on AppSource: appsource.microsoft.com

Have additional questions? Request a consultation with our experts: