In today’s aviation business, accuracy, speed, and efficiency are critical. Every minute of delay in processing documentation or reporting can result in additional costs and managerial risks. For example, as SkyUp Airlines scaled its operations and recognized the importance of strategic transformation, it actively adopted advanced digital solutions. One of these initiatives was the implementation of the iFly Res system, which automated and enabled flexible management of bookings, improved customer experience, and ensured compliance with international standards.

At the same time, the company’s internal business processes also required digital transformation. For many years, SMART business has been the technology partner of SkyUp Airlines, having implemented SMART HCM & LMS (human capital management), SmartPoint Intranet (a unified communication environment), and SmartPoint DMS (document management).

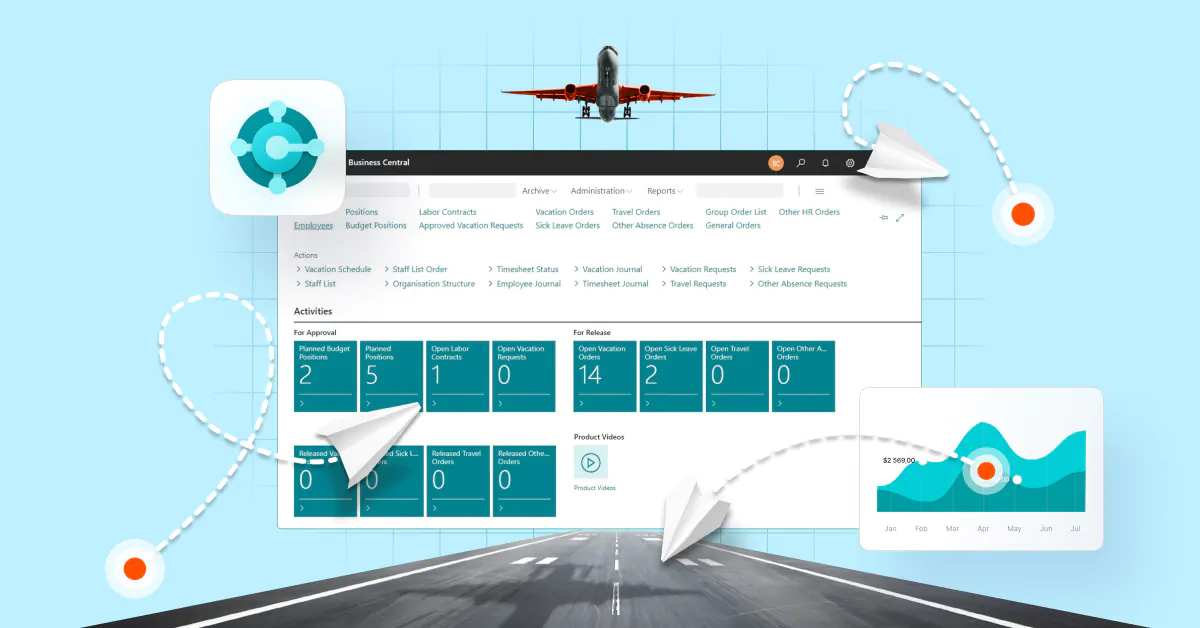

Providing services across multiple European jurisdictions, SkyUp Airlines eventually faced the need to optimize its financial operations. The implementation of Microsoft Dynamics 365 Business Central together with SMART Accounting addressed this challenge. The rollout enabled automation of key financial operations and reporting, data consolidation, and a unified system for efficient management of accounting documentation. Explore this success story by SMART business to find out what steps the company took on its implementation journey!

Background: The Need for an ERP System to Address New Challenges from Rapid Growth

SkyUp Airlines continues to expand its presence in the international market each year. In 2023, the company operated 10,528 flights, transported over 1.5 million passengers, served 664 routes, and partnered with 55 airports. The increase in international routes, collaboration with multiple partners, and the need to comply with local regulatory requirements in each country all demanded effective control and centralized financial management. Such rapid growth brought not only new opportunities but also additional challenges. The search for a reliable ERP system became a strategic decision, driven by the following challenges:

- Need for unified financial processes – Operating across multiple European jurisdictions with different accounting and tax requirements created a demand for a consolidated system to facilitate efficient accounting.

- Rapid scaling – The fast pace at which the company opens new markets required a comprehensive tool capable of integrating new offices and supporting business growth without compromising the efficiency of key processes.

- Control of financial processes – In different countries, the company dealt with multiple currencies, tax systems, and reporting requirements. A system was needed to consolidate all reporting and provide transparent access to financial data.

- Ensuring transparency and oversight – During periods of rapid growth, it was critical to maintain full transparency of all financial operations. Without a reliable management system, there was a risk of losing control over specific processes, potentially resulting in financial errors or losses.

- Automation of business processes – Scaling operations meant an increase in transaction volume and documentation. Automation was necessary to reduce human error, accelerate processes, and improve operational efficiency.

- Compliance with international standards and local regulations – Operating in an international environment required adherence to global financial reporting standards and country-specific regulatory requirements. Compliance with standards such as IFRS, GDPR, and local tax and accounting regulations was critical to ensure legal compliance and stable operations across jurisdictions.

“After analyzing our needs and the software market, we chose the ERP system Microsoft Dynamics 365 Business Central. It allowed us to manage financial processes centrally, optimize accounting and tax management, and ensure compliance with local legislation. The system proved to be the most flexible for optimizing, scaling, and automating our business processes both in Ukraine and abroad. We conducted a tender among Microsoft partners, and SMART business won, implementing the solution in line with our business requirements.”

An important role in the implementation project was also played by SMART Accounting, a solution developed by SMART business. It ensured that Microsoft Dynamics 365 Business Central complies with Ukrainian accounting and tax standards. Thanks to this solution, SkyUp Airlines was able to automate the company’s financial accounting in accordance with national regulations, simplify work with tax reporting, and ensure transparency of its financial operations.

Why Did SkyUp Airlines Choose the Business Central ERP System, and What Are the Key Benefits of Implementing It with SMART Business?

For SkyUp Airlines, the ERP system Microsoft Dynamics 365 Business Central was an obvious choice due to its extensive localization options for various European countries. This powerful platform enables comprehensive business process automation for companies operating across multiple jurisdictions within a unified digital ecosystem. Moreover, Business Central is supported by a network of experienced partners capable of developing and adapting solutions even for countries where Microsoft has not released an official localization.

It is important to note that SkyUp Airlines itself uses a Microsoft ERP system in several countries: Ukraine, Poland, Romania, and the Czech Republic.

SMART business became the partner that adapted Business Central for multiple markets within its strategic initiative Localization HUB (for example, SkyUp Airlines uses SMART business localization in both Ukraine and Poland). This vendor-driven initiative is aimed at expanding the ERP system’s functionality and adapting it to local and specific business requirements in different countries. Within this initiative, the vendor implemented the Ukrainian localization of Dynamics 365 Business Central, enhanced with the SMART Accounting extension. This made it possible to unify the company’s financial and accounting processes in a single system while meeting the following customer requirements:

- Compliance with Ukrainian legislation — SMART Accounting is adapted to national accounting standards, tax laws, and regulatory requirements.

- Automation of financial reporting — the solution automates the generation of reports, accounting documents, tax invoices, and other reports required by the tax authorities.

- Integration with government systems — SMART Accounting enables convenient submission of reports through the electronic taxpayer’s portal, supporting all necessary formats for tax declarations and other types of reporting.

- Advanced accounting management — the solution supports multi-level analytical accounting, covering both primary and additional analytical dimensions. This allows for in-depth financial data analysis and cost optimization.

- Transparency and control at all accounting stages — SMART Accounting includes automated data validation features that minimize the risk of errors and ensure compliance with XSD schemas and regulatory standards.

- Convenient data access and analysis — all documents and reports are stored within a single system, allowing users to easily search, analyze, and use them for strategic planning and operational decision-making.

It is worth noting that as a business scales, the standard functionality of Microsoft Dynamics 365 Business Central already covers most of a company’s financial and operational needs. However, to meet the specific requirements of local legislation, additional adaptation may be required. In such cases, the SMART business team provides system localization, configuring it to meet the accounting and tax requirements of a given country — enabling companies to quickly and smoothly integrate into new markets.

Implementation Stages and Benefits of the Self-Service Model Chosen by SkyUp Airlines

The implementation process was carried out in stages, allowing the SkyUp Airlines team to gain deep familiarity with the system’s functionality and quickly move to its active use:

- Introductory Training — In the first stage, training sessions were held to familiarize the team with the capabilities of SMART Accounting.

- Analysis and Customization — SkyUp Airlines consultants and technical specialists, together with SMART business experts, conducted a series of technical sessions to identify necessary system adaptations.

- Implementation of Customizations — Required changes were implemented to ensure maximum alignment of the system with the company’s business processes and the specifics of operating in different markets. The vendor performed targeted customizations for European jurisdictions, including enhanced analytics for VAT calculation and configuration for the chief accountant to efficiently prepare and submit VAT reports according to the requirements of the jurisdictions where the airline operates.

- Team Training — The vendor conducted a series of training sessions for accountants and technical specialists, ensuring rapid staff adaptation to the new system.

- Go-Live — After successful testing, SkyUp Airlines deployed SMART Accounting in the production environment independently, selecting the Self-Service model.

The Self-Service model significantly accelerated and optimized the system deployment process. This approach offers several key benefits:

- Resource savings on implementation — Self-Service reduces costs for engaging external integrators, as the company can perform most of the configurations internally. This approach was successfully applied at SkyUp Airlines, substantially lowering initial expenses and allowing resources to be redirected toward further system improvements.

- Flexible integration for specific needs — Thanks to an intuitive interface and broad functionality, SkyUp Airlines was able to quickly adapt the system to its operational processes and the local requirements of European markets.

- Preservation of internal control and security — Since deployment was largely handled internally, SkyUp Airlines maintained full control over access configurations, user permissions, and overall security policies. This provided additional protection of data according to the company’s internal information security standards.

- Updates and compliance with local legislation — Automatic updates ensure compliance with local legal requirements and guarantee that the system always operates with up-to-date settings, even amid frequent changes in legislation.

- Rapid scaling to new markets — Independent deployment of SMART Accounting enables SkyUp Airlines to roll out the system in new countries without delays caused by searching for or coordinating with external integrators. This autonomy accelerates scaling and allows the company to respond promptly to new market needs and changes.

“Thanks to the Self-Service format, SkyUp Airlines were able to independently deploy both production and test environments, prepare configurations, and set up access. At the same time, SMART business provided support for complex tasks or specific cases. As a result, the client team gained deep understanding of the system’s functionality and was able to start using it in a short timeframe.”

As part of the project, SkyUp Airlines also received another important tool — SMART SAF-T UA, a solution for automated generation and submission of electronic tax reports in the standardized SAF-T format, compliant with the current requirements of the State Tax Service of Ukraine. For a large taxpayer like SkyUp Airlines, SMART SAF-T UA represented an investment in transparency and accuracy of financial processes, ensuring compliance with new tax requirements, reducing risks during audits, and providing confidence in business stability. Tight integration with Microsoft Dynamics 365 Business Central creates a unified environment for financial and tax data, giving SkyUp Airlines readiness for inspections and instant access to all necessary information.

“Our company serves as a gateway to process automation for those aiming to grow internationally. Through a comprehensive approach, SMART business creates complete ecosystems of solutions that provide a modern and, most importantly, efficient model of business management”.