Implementing Dynamics 365 Business Central in Czechia: An Overview of Microsoft Localization by SMART business

Blog

- All

- News

- Success stories

- Releases

March 4th, 2025 9 min read

February 24th, 2025 3 min read

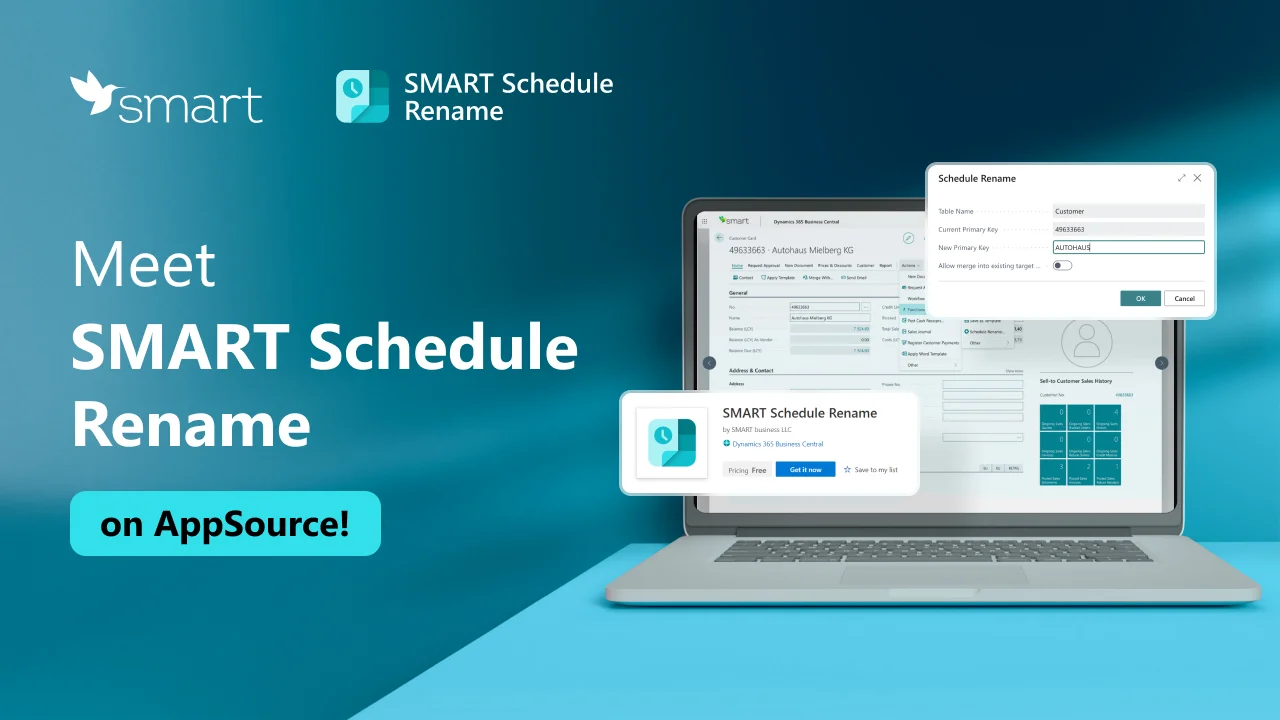

SMART Schedule Rename – A Simple and Free App for Master Data Updates

February 18th, 2025 2 min read

Minor Update 2025.01/2 for SMART Accounting

February 17th, 2025 8 min read

SMART Cash Flow Release — A Solution for Effective Cash Flow Management

February 3rd, 2025 11 min read

Implementation of SAF-T UA Reporting: What Changes Will Occur in E-Audit, and How Does Automation Ensure Readiness for Them?

January 30th, 2025 4 min read

The Importance of Updating an ERP System for Business Development

January 30th, 2025 3 min read

Minor Update 2025.01/1 for SMART Accounting and SMART Payroll

December 31st, 2024 5 min read

January 2025 updates for SMART Accounting and SMART Payroll

December 16th, 2024 4 min read

Challenges of the Digital Age and the Role of ERP Systems in Business Success